Examining the Difference between 3PLs and 4PLs

“4PLs deliver solutions which are more ‘systemic’ for customers, resulting in higher efficiencies, simplified reporting and improved analytics by optimizing supply chain flows throughout the ‘purchase-to-pay’ or the ‘order-to-cash’ cycle for their customers.” – Lynn Failing, Executive Vice President – Logistics & Supply Chain, Kimmel & Associates

Outsourcing is a practical option for many businesses for varied reasons. It could be to increase shareholders’ assets, reduce costs, transform a business, improve operations, overcome lack of internal capabilities and so on.

In a nutshell, outsourcing is used where possible, particularly in the logistics industry. However, for so long, third party logistics (3PLs) have led the way in logistics outsourcing, drawing on its core business, whether it be forwarding, trucking or warehousing, and providing other services for customers.

Customers anxious to reduce costs now want what 3PLs have to offer. The potential market opportunity for outsourced logistics service providers, whether domestic, international and/or global is huge.

Entering in this vacuum created by 3PLs, are fourth party logistics providers (4PLs). They differ from 3PLs as they act as Business Processing Outsourcing (BPO) in a typical logistics business.

This Lead Logistics Provider adds value and re-engineers customer’s approaches and needs. A 4PL is neutral and will manage the logistics process, regardless of what carriers, forwarders or warehouses are used. The 4PL organization can and will also manage 3PLs that a customer use by developing solutions tailored to meet the unique and special needs of each customers, without regarding the parent company’s service offerings.

The global logistics services (3PL & 4PL) market is valued at $751.80 million in 2017 and is expected to reach $982.45 million by the end of 2022, growing at a CAGR of 4.56% between 2017 and 2022, according to WiseGuyReports.Com. Asia Pacific will account for the lion share of growth, especially in China, India and South Asia regions.

The global logistics services (3PL & 4PL) market is valued at $751.80 million in 2017 and is expected to reach $982.45 million by the end of 2022, growing at a CAGR of 4.56% between 2017 and 2022, according to WiseGuyReports.Com. Asia Pacific will account for the lion share of growth, especially in China, India and South Asia regions.

In an email interview with Lynn Failing, Executive Vice President – Logistics & Supply Chain at Kimmel & Associates, Air Cargo Update discussed the role of 4PL providers in the supply chain and how is it different from traditional 3PL providers?

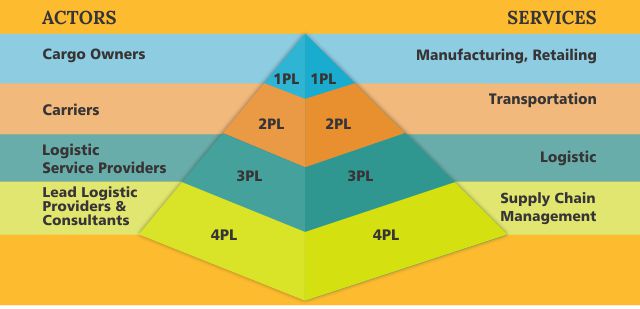

Layers of PLs

In the PL terminology, it is important to differentiate the 3PLs with 4PLs from other logistics layers such as First Logistics Providers (1PL) and Second Logistics Provider (2PL).

First Party Logistics (1PL). Beneficial cargo owners, which can be the shipper (such as a manufacturing firm delivering to customers) or the consignee (such as a retailer picking up cargo from a supplier). They dictate the origin (supply) and the destination (demand) of the cargo with distribution being an entirely internal process assumed by the firm.

Second Party Logistics (2PL). Carriers providing a transport service over a specific segment of a transport chain. It could involve a maritime shipping company, a rail operator or a trucking company that are hired to haul cargo from an origin (e.g. a distribution center) to a destination (e.g. a port terminal).

Lynn Failing explains, “Let’s try a different picture. Not layers of a cake. More like slices in a pie. A 3PL offers one slice of service. 4PL’s combine two or more service offerings in a ‘one slice solution’ package. A 4PL could combine international freight and deconsolidation services. Or any other two.

“To make it even more complicated, most large global 3PLs, like FedEx, UPS and DHL, also sell integrated 4PL services. As 4PL’s ‘bundle’ service offerings, they also can – and often do – ‘unbundle’ their 4PL co-ordination role, just to sell a single service to a customer.”

3PLs vs. 4PLs – The Difference

Learning the difference between a 3PL providers and 4PL providers and as well as 1PL and 2PL and the rise of even a 5PL is both confusing and highly debated among experts in the supply chain industry.

The generation of 4PLs is evolving and advancing to an extent from the legacy of 3PLs work scope with specific themes created to address value-added require-ments with clients’ partnership.

The basic concepts of 3PLs are here to stay (specifically asset-based providers) and the evolution to extend services as a 4PL will be the deciding factor many shippers (small companies or large multi-national companies) stand on in their selection of a provision partner.

Naturally, we do see spin-offs again, from a 4PL pint-of-view, whereby some retain specialty in specific knowledge & skill-sets (i.e. IT / MRP / direct & indirect sourcing etc.), but yet there are many of the 4PLs who would be entrenched in the general provisions as “3PL managers” to co-ordinate the overall fulfillment processes B2B2C ultimately,” according to Adrian Chen, an Advisory Board Member (Asia Pacific) at ISCEA Internal Supply Chain Education Alliance.

Failing of Kimmel Associates, said, “Whenever a company outsources all or any part of its logistics or transport functions to another company, this company is using a ‘third party’ to do this function. 3PL’s come in all shapes and sizes, and they perform a whole variety of outsourced logistics functions for a company: customs clearance, international freight movement, inbound and outbound transportation, warehousing, cross-docking, fulfillment and even reverse logistics.

“4PL emerged because some 3PLs in the marketplace offer more than one outsourced logistics function. By combining these service offerings from a single source, these companies became known as Fourth Party Logistics Providers or 4PLs”.

Also referred to as the Leading Logistics Provider (LLPs), 4PLs have a broad role within the supply chain. They assume many of the similar roles as 3PLs but have a much broader responsibility and accountability in helping the client reach its strategic goals.

Accountability and control help differentiate a 3PL from a 4PL, according to Penske Logistics, “As a 4PL we become a trusted advisor and the customer becomes reliant on our data to drive them forward,” said Penske Logistics Senior Vice President Any Moses.

Working together

When a 3PL transitions to a 4PL, it changes the type of information the provider may access. Transparency is key for 4PLs that may also function as a 3PL. They must proactively work with customers to demonstrate the checks and balances they put in place, such as creating confidentiality agreements that prohibit the sharing of information and data from the customer’s other 3PLs and transport- ation providers.

“Transparency is both essential and inevitable. 3PLs typically act as ‘sub-contractors’ through the 4PL. This means that, real-time transparency is built into a seamless EDI link, which links all the parties. Ask anyone involved in an EDI rollout. It’s always a challenge, but worth every bit of money and sweat you put in, when your client sees it at work,” adds Failing.

3PLs and 4PLs operate the same way but consist of different parts. A 3PL company arranges freight carriers and warehousing by dealing directly with the service providers. A 4PL company, on the other hand, arranges the same services and more for a client but does so by employing companies such as 3PL companies, who use their vast network of carriers and warehousing providers.

4PL companies manage these 3PL companies and other companies to provide a client with a comprehensive, end-to-end supply chain.

“Preferably, these services are integrated, or ‘bundled,’ together by the provider. Services they provide transportation, warehousing, cross-docking, inventory management, packaging and freight forwarding.

In 2008, the United States passed legislation declaring that the legal definition of a 3PL is ‘A person who solely receives, holds, or otherwise transports a consumer product in the ordinary course of business but who does not take title to the product.

“It is possible for a major third-party logistics provider to form a 4PL organization within its existing structure,” says Failing.

However, a 4PL is neutral and will manage the logistics process, regardless of what carriers, forwarders, or warehouses are used. The 4PL can and will even manage 3PLs that the customer is already currently using. Many 4PLs have addressed the huge requirements of electronic interface between numerous companies.

Tuning the supply chain

The supply chain management (SCM) profession has continued to change and evolve to fit the needs of the growing global supply chain. With the supply chain covering a broad range of disciplines, the definition of what is a supply chain can be unclear.

Supply chain management is an integrating function with primary responsibility for linking major business functions and business processes within & across companies into a cohesive and high-performing business model. It includes all of the logistics manag-ement activities noted above, as well as manufacturing operations, and it drives coordination of processes and activities with and across marketing, sales, product design, finance, and information technology.

“4PLs’ promise and generally deliver solutions which are more ‘systemic’ for their customers, usually resulting in higher efficiencies, simplified reporting and improved analytics by optimizing supply chain flows throughout the ‘purchase-to-pay’ or the ‘order-to-cash’ cycle for their customers,” notes Failing.

Digitally optimizing the supply chain

The increasing digitization of freight transportation is opening the door to a new kind of management company within the supply chain: the 4PL.

Third-party logistics (3PL) providers have been successfully managing companies’ operations for years. But with new data streams and techno-logies such as blockchain that will allow disparate systems to operate in a single, unified and trusted chain, the rise of the 4PL may be upon the industry.

The introduction of 4PLs are not new – they have been around for some time – but their mainstream use is growing, due in large part to advances in technology.

“All 3PLs and 4PLs use increasingly sophisticated technology platforms to serve their customers better. For example, Transportation Management Systems. In addition, 3PLs and 4PLs also offer an electronic data interface (EDI) which allows their customers visibility into whether it’s freight tracking,” Failing said.

Previously, different software systems and goals made it difficult for one party to control an entire supply chain. That is changing.

When asked if 4PLs or other PLs would replace each other in the future Failing replied, “Absolutely not. There will always be room for ‘niche’ players, which can provide unique value in particular industry verticals or geographies. However, the continuing changes means that M & A activity will continue to be lively in this sector in the coming years”.

Furthermore, Lynn Failing believes the future of 4PLs is “bright” as 4PLs offer more complex and integrated “one stop” solutions for manufacturers, retailers and trading companies around the world.