Effective 28 October 2018, Etihad Airways will increase its flights from Abu Dhabi to Canada’s largest city, Toronto, from three to five weekly services.

Boeing 777-300ER aircraft, featuring 40 seats in Business Class and 340 in Economy Class, will operate the flights.

Robin Kamark, Chief Commercial Officer, Etihad Aviation Group, said, “We are thrilled to announce more flights to cosmopolitan Toronto, one of the most successful and popular destinations on our global route network. This news has been eagerly anticipated.

“We have welcomed well over a million guests on our flights to Toronto since we launched the service almost 13 years ago. This development is great news for UAE nationals, for who Canada is an exciting trade, touristic, and cultural partner, and for Canadians, including the thousands residing here in the emirates. The UAE is also Canada’s largest export market in the MENA region, so the extra services are a boost for trade to and from the area and beyond.”

Etihad Airways inaugurated services to Toronto on October 2005, and since then the route has proved very successful for the airline, recording consistently strong demand to and from both cities.

Approximately 45,000 Canadian citizens reside in the UAE, with over 150 Canadian companies registered across the country. Citizens of both countries now enjoy visa-free entry for business and tourism on stays of up to six months.

Etihad Airways has a codeshare partnership in place with Air Canada, with the Canadian flag carrier placing its ‘AC’ code on Etihad services from Toronto to Abu Dhabi and from London Heathrow to Abu Dhabi. Under the agreement, Etihad Airways places its ‘EY’ code on Air Canada’s multiple daily services from Toronto to points across Canada including Montreal, Winnipeg, Saskatoon, St.Johns, Halifax, Regina, and Fort McMurray.

The additional frequencies will also benefit Etihad Cargo customers who can expect greater schedule flexibility and a 60 per cent cargo capacity increase on the route.

The future of urban passenger and cargo transport is electric says MAN, which is transforming from a manufacturer of commercial vehicles to a provider of intelligent and sustainable transport solutions.

The Munich-based MAN Truck & Bus is one of the leading international suppliers of commercial vehicles and transport solutions in Europe, and in today’s digital world, it uses the CAVE, short for Cave Automatic Virtual Environment, to create precise models of trucks and buses before the first physical prototype is made and the mass production starts.

In the CAVE (Cave Automatic Virtual Environment), MAN engineers create an exact virtual mock-up of their vehicle designs. This enables many conflicts to be identified and eliminated before the first real prototype is built.

In the CAVE (Cave Automatic Virtual Environment), MAN engineers create an exact virtual mock-up of their vehicle designs. This enables many conflicts to be identified and eliminated before the first real prototype is built.

When developing new models, MAN Truck & Bus produces virtual prototypes in a three-dimensional lab so as to detect possible faults well before the start of production. It is all made possible by the “Cave Automatic Virtual Environment” (CAVE), a 46 square metre high-tech creative design facility at the MAN site in Munich.

Its five high-performance computers incorporate high-end graphics cards, infrared cameras and stereo projectors featuring 2K image resolution for four large screens.

Around a year before the start of the actual build, the CAVE enables involved persons to move around an exact virtual mock-up of the new truck or bus model using a 3D headset and controller, and thereby clear up some key questions at an early stage in the process: Are all the component units optimally accessible? Does the product or the manu-facturing process need to adapted in any way?

“The advantage of Virtual Reality is that it saves us time, material, and a lot of money,” comments MAN advance development and prototyping engineer Martin Raichl. The CAVE also enables MAN to master a challenge posed by the modular kit system and by the range of different commercial vehicle models it produces: a bracket might fit perfectly in the MAN Lion’s Coach, for example, but need adapting for installation in service bus models.

Advance 3D buildability testing enables CAVE staff to identify any potential conflicts in good time.

Virtuality on the march

A joint undertaking by MAN’s Production, Development and Logistics functions, the CAVE’s investment cost of around EURO 500,000 was quickly amortised, considering the deviations which the virtual prototypes identify and  therefore prevent from being built into the real vehicles: as many as 50 percent of all potential deviations are identified in the CAVE, meaning they do not lead to costs in the subsequent production process.

therefore prevent from being built into the real vehicles: as many as 50 percent of all potential deviations are identified in the CAVE, meaning they do not lead to costs in the subsequent production process.

And the CAVE’s success is being replicated across the commercial vehicle manufacturer’s operations: other MAN sites in Nuremberg (Germany), Steyr (Austria), Ankara (Turkey) and Starachowice (Poland) are now also employing virtual labs. Real-time connectivity among the various MAN CAVEs enables colleagues to collaborate on the same virtual models simulta-neously across national borders.

The technology itself is also being continually refined. Recently, MAN’s engineers began using head-mounted displays (Virtual Reality headsets) in the CAVE as a way to experience their vehicle designs even more accurately and realistically.

In future they are looking to introduce full-body tracking, in order to even simulate the physical stresses such as a technician might undergo when installing an exhaust silencer for example.

AI Powered Vehicles

MAN Truck & Bus is set to showcase its advances in the fields of electromobility, digitisation and autonomous vehicles at its exhibit at the IAA Commercial Vehicles 2018 in September in Hanover, Germany, alongside its latest product highlights for trucks and coaches.

MAN will also be exhibiting the MAN eTGE, a battery electric version of the new MAN transporter, at IAA. In doing so, MAN is one of the first manufacturers to present all-electric solutions for the entire scope of city logistics applications between 3 and 26 tons.

For Joachim Drees, Chief Executive Officer of MAN Truck & Bus AG, this is the most important field of use for electric commercial vehicles: “The urban environment is where eTrucks can truly demon-strate their strengths. They have zero local emissions and therefore contribute to improving the city air. What’s more, they are extremely quiet, meaning that in future it may be possible to make deliveries to supermarkets at night, for example – solving the problem of daytime traffic.”

For Joachim Drees, Chief Executive Officer of MAN Truck & Bus AG, this is the most important field of use for electric commercial vehicles: “The urban environment is where eTrucks can truly demon-strate their strengths. They have zero local emissions and therefore contribute to improving the city air. What’s more, they are extremely quiet, meaning that in future it may be possible to make deliveries to supermarkets at night, for example – solving the problem of daytime traffic.”

“For us, one thing is clear: the future of urban passenger & cargo transport is electric. When it comes to city buses too, things are certainly moving in the direction of electric power. For this reason, MAN has concluded development partnerships with Munich, Hamburg, Wolfsburg, Luxembourg and Paris with the aim of incorporating people’s everyday experiences into series development. A prototype of the MAN Lion’s City E will also be on show for the first time at this year’s IAA.”

The next step? To introduce a demo fleet of electric buses into everyday use in various European cities before series production of the battery electric version of the new MAN Lion’s City can finally get under way. This extensive trial will ensure that the vehicles can meet the high reliability standards required for use in local public transport.

In previous years, it was mainly the new bus and truck models that characterised the exhibits showcased by MAN Truck & Bus at IAA. Yet recently, digital innovations have increasingly come into the mix.

“MAN is changing from a manufacturer of commercial vehicles to a provider of intelligent and sustainable transport solutions,” Drees noted, adding, it was for this reason that MAN founded the digital brand RIO in 2016 as a way of connecting the world of transport with the aid of an open, cloud-based platform and making it more economical and ecological.

In order to underline this cross-manufacturer and open approach, RIO has been a separate, independent brand under the umbrella of Volkswagen Truck & Bus since 2017.

First Priority Cargo prioritizes speedy and accurate delivery of goods, focusing on building a niche market and earning the reputation as one of the leading freight service providers in the world.

Adapting to the latest trends and embarking on a journey to meet and exceed freight forwarding requirements, the company aims to offer the best and most feasible solutions to its clients. With a renowned name in the industry, First Priority Cargo owns its success to its extensive team of professionals with a common goal to accomplish the mission and vision of the firm. The company aspires to develop and establish sea, land and air freight alliance to improve the quality of service offered to its customers.

“We excel in rendering total logistics solutions building close partnerships as well as relationships. The secret to our success is the excellent service we provide to our customers at very economical rate. Boasting a fleet of pickups tirelessly functioning within the UAE and a proprietary network spanning numerous countries, First Priority Cargo envisions excelling in its quest to deliver the best service in the industry,” explains Anvar Majeed in an email interview with Air Cargo Update.

Majeed holds a Master’s Degree in Logistics and Supply Chain Management and is currently the Director for First Priority Cargo.

Please share with us recent achievements by First Priority Cargo?

We have won 2 awards last month from two major carriers AIRFRANCE/KLM-Cargo and Turkish Cargo.

Our group VP Business Intelligence-Dilip Sitlani has moved us ahead with new ideas and innovations and signed up with Sharjah Airport for a screening machine in our facility and would be the first agent in UAE to have this facility of pre-screening.

How do you focus on building a niche market and earning the reputation of leading freight service provider?

I believe this is purely based on customer service levels; we thrive on making our customer happy and sticking to our commitment.

What have been your major challenges in the industry and how did you overcome it?

Major challenges have been the fuel surcharge by the airlines increasing monthly, we fire fight in different ways and means without impacting our prime customers.

Your core business philosophy?

On time cargo around the world. Including our core sectors of the African market.

Having the right partnership is integral to the growth of your business? Why is it so?

Keeping in mind most topnotch companies have merged for better partnership, IE- EK & FLY DUBAI – EY and 9W then what’s stopping us from getting a big brand helping us move ahead with the times. Having our new VP Business intelligence-Dilip Sitlani on board we have managed to tie up some big labels and brands for their import & export needs.

The UAE logistics sector is gaining momentum as more and more startups open their offices, offering latest solutions and services such as timely delivery, real time tracking and so on? What is your opinion on this?

This is the way forward, we have gone that way. Our IT in-house has developed a software to track all shipments and the customer can track his cargo via a cellular app as well.

The Internet boom in the UAE did boost the e-Commerce growth in the last couple of years but the biggest challenge that still remains is timely delivery? Where does First Priority come into this?

We are looking at that segment. But personally, feel it is about the rate factor. e-Commerce loads pay very low yields that profits only the integrators and we may go that direction if the market supports us, mainly the airlines with the rates to match the customer needs. Volumes are high but on very low margins.

Though the industry is becoming competitive the question remains what innovations are you bringing to the table to help capture your market share?

Door to Door-Anywhere in the world and having an aircraft contracted under First Priority Cargo for – 12 months of the year to help the customer gain faith in our company. Our prime selling USB and on time performance to ensure the customers’ cargo reaches on time. Happy Days.

The Farnborough International Airshow, held from July 16 to 22, was a huge success, in terms of aircraft and engine orders totalling US$192 billion, even as the air was thick of questions on how Britain’s aerospace and defense sectors would deal with Brexit when it eventually happens in March 2019.

The bi-annual international airshow recorded over 1,400 commercial aircraft orders valued at USD 154 billion, while engine orders notched up 1,432 deals worth USD 21.96 billion.With 676 orders (US$92 billion), the US-based Boeing outnumbered its European competitor with just 431 orders (US$70 billion).

Farnborough International Chief Executive Gareth Rogers said, “The major deals announced this week demonstrate how confident the aerospace industry is and the role of Farnborough as an economic barometer.” There was also a near-10 percent rise in trade visitors compared to previous years, with over 80,000 visitors passing through the gates.

Freighter orders gain momentum

Also making up these huge orders were regional airlines and freighter segment. Brazilian aerospace major Embraer announced on Day 2 orders worth US$15.3 billion for a whopping 300 regional aircraft, while freighters had a good run too.

DHL Express ordered 14 Boeing 777Fs, calling the purchase the beginning of ‘a gradual replacement of our older inter-continental fleet’ and also mentioning that it would meet the growing demand for global express capacity.

Each 777F offers a payload of up to 109 tonnes. The express carrier operates a fleet of over 260 aircraft over a network of 220 countries. Boeing inked a deal with Volga-Dnepr Group and Cargo Logic Holding firming up an order for five 747-8F and covering a letter of intent for 29 777Fs. Qatar Airways also ordered five 777Fs as it is consolidating its cargo business. Qatar Airways has 13 Boeing 777Fs, two 747-8Fs and eight A330-200Fs. It is yet to get delivery of nine aircraft (including the five of Farnborough).

The agreement signed between Boeing and Volga includes future fleet expansion plans which range from buying new or converted 767 freighters to the possible purchase of 737-800 Boeing converted freighters. It also includes a Boeing Global Services agreement to support the planning and operation of the airline’s 300 crew members.

The agreement signed between Boeing and Volga includes future fleet expansion plans which range from buying new or converted 767 freighters to the possible purchase of 737-800 Boeing converted freighters. It also includes a Boeing Global Services agreement to support the planning and operation of the airline’s 300 crew members.

Boeing’s freighter forecast

Boeing has stated that the demand in the freight market grew nearly 10 percent last year, and the company had over 100 orders and commit-ments for production and converted freighters so far in 2018.

In the 2018 Boeing Commercial Market Outlook, the US giant’s Vice President for Marketing, Randy Tinseth said that “Cargo has, in many ways, taken center stage at this show.” He added that “Over the last two years we have seen a definite uptick in air cargo as a result of an economy that’s now going above trend, as well as a return in trade and a return in industrial production.”

The Market Outlook stated there would be a demand for 980 new freighters over the next two decades, 510 of which would be large aircraft such as the 747-8F and 777F and 470 medium freighters like the 767-300F.

In the forecast, the US giant said there would be a healthy demand for converted freights, going up to 1,670 by 2037, of which about 500 would be wide-bodied and 1,200 single-aisle aircraft. The total cargo fleet is expected to grow by 60 per cent over the next 20 years, increasing from 1,870 to 3,260 freighters.

Thanks to e-commerce there is an encouraging upward movement in the growth of air cargo. The International Air Transport Asso-ciation (IATA) stated that though airfreight capacity outgrew demand, airlines were adding to their fleets, a sign that good times were on the horizon.

Cargo conference

Panelists at the Farnborough conference, held in Cargo Village, were excited about the prospects for the cargo segment, while they voiced the challenges that were imminent with growth. The Cargo Village which made its debut in the previous edition has remained in the same place, away from all the major activity, away from all the media glare. It is time to rethink and reposition cargo to get better visibility.

Moderating the conference, the Global Cargo Head of International Air Transport Association (IATA), Glyn Hughes said that 2017 indicators were that e-commerce would further drive cargo growth. In 2017, about 60 million tonnes of freight was transported, recording a growth of 9 percent over the previous year.

He said the sector was in mission mode with modernization in place and there was demand for air cargo from high value-to-weight manu-factured products such as micro-electronics, pharmaceuticals, aerospace components and medical devices. He added that supply chains were becoming more customer-centric and solutions were being developed that enhanced freight quality and service. IATA’s Cargo IQ measurement showed that it took an average 1.41 days for cargo to be cleared through customs in 2017, accelerated through put.

The CEO of Cargo Logic Air (CLA), David Kerr, talked about how CLA had positioned itself to address the UK air cargo market in the background of Brexit. “The growth of UK airports and aviation is not just about noise and pollution, it is about trade and the future of UK business. Air cargo can be the engine of UK’s economic growth and we at CLA look forward to playing a leading role in that progress.”

Britain’s aerospace industry had a turnover of US$45.9 billion of which goods worth 85 percent were exported.

Kerr pointed out that “At a time when the UK government is defining its aviation policy in the context of Brexit, we must ensure that the needs of the cargo and its importance to UK plc are at the forefront of everyone’s minds.” Airports, he said, had to give air cargo priority, away from the low priority it is getting now, thus affecting growth of the economy itself.

e-Commerce key driver

While infrastructure challenges remained, the need to work around e-commerce requirements was underscored by many speakers. The Managing Director of Seabury Consulting, Marco Bloeman, said e-commerce and small parcels were keys to growth as indicated by the results in the last quarter of the financial year which had significant number of shipments.

Echoing similar views, Henk Venema, the Head of Network Carrier Management, DHL Global Forwarding, said the e-commerce segment was providing the integrator with challenges. “From a freight forwarding view we are doubting if e-commerce is an opportunity or a competitor for space.”

The way Amazon and Ali Baba are leveraging different modes of logistics is surprising all. The air cargo sector had to be quick on its feet to adapt itself to technologies and work as an industry, rather than working in silos.

The Chief Cargo Officer of Turkish Cargo, Turhan Ozen, said e-commerce was an opportunity and that airlines had to look at ways of tapping this fast emerging segment. E-commerce is going to grow hugely, he mentioned as end consumers were looking for speed of delivery, promptness and reliability.

Abdulla Shadid, Managing Director of Cargo and Logistics Services, Etihad Airways, said Customs continued to be problematic for air cargo business, particularly when global trade was on the rise.

The variations in Customs from China to the European Union and the Middle East were very challenging, affecting seamless movement of goods. However, he said with IT systems coming into play, operations were becoming seamless and there was need to invest heavily in such processes and standardise them globally.

He also suggested that it’s time human resources pay attention to industry salaries and how to retain talents which currently is in short supply.

“4PLs deliver solutions which are more ‘systemic’ for customers, resulting in higher efficiencies, simplified reporting and improved analytics by optimizing supply chain flows throughout the ‘purchase-to-pay’ or the ‘order-to-cash’ cycle for their customers.” – Lynn Failing, Executive Vice President – Logistics & Supply Chain, Kimmel & Associates

Outsourcing is a practical option for many businesses for varied reasons. It could be to increase shareholders’ assets, reduce costs, transform a business, improve operations, overcome lack of internal capabilities and so on.

In a nutshell, outsourcing is used where possible, particularly in the logistics industry. However, for so long, third party logistics (3PLs) have led the way in logistics outsourcing, drawing on its core business, whether it be forwarding, trucking or warehousing, and providing other services for customers.

Customers anxious to reduce costs now want what 3PLs have to offer. The potential market opportunity for outsourced logistics service providers, whether domestic, international and/or global is huge.

Entering in this vacuum created by 3PLs, are fourth party logistics providers (4PLs). They differ from 3PLs as they act as Business Processing Outsourcing (BPO) in a typical logistics business.

This Lead Logistics Provider adds value and re-engineers customer’s approaches and needs. A 4PL is neutral and will manage the logistics process, regardless of what carriers, forwarders or warehouses are used. The 4PL organization can and will also manage 3PLs that a customer use by developing solutions tailored to meet the unique and special needs of each customers, without regarding the parent company’s service offerings.

The global logistics services (3PL & 4PL) market is valued at $751.80 million in 2017 and is expected to reach $982.45 million by the end of 2022, growing at a CAGR of 4.56% between 2017 and 2022, according to WiseGuyReports.Com. Asia Pacific will account for the lion share of growth, especially in China, India and South Asia regions.

The global logistics services (3PL & 4PL) market is valued at $751.80 million in 2017 and is expected to reach $982.45 million by the end of 2022, growing at a CAGR of 4.56% between 2017 and 2022, according to WiseGuyReports.Com. Asia Pacific will account for the lion share of growth, especially in China, India and South Asia regions.

In an email interview with Lynn Failing, Executive Vice President – Logistics & Supply Chain at Kimmel & Associates, Air Cargo Update discussed the role of 4PL providers in the supply chain and how is it different from traditional 3PL providers?

Layers of PLs

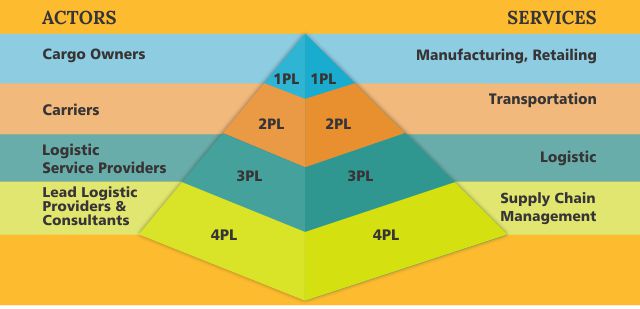

In the PL terminology, it is important to differentiate the 3PLs with 4PLs from other logistics layers such as First Logistics Providers (1PL) and Second Logistics Provider (2PL).

First Party Logistics (1PL). Beneficial cargo owners, which can be the shipper (such as a manufacturing firm delivering to customers) or the consignee (such as a retailer picking up cargo from a supplier). They dictate the origin (supply) and the destination (demand) of the cargo with distribution being an entirely internal process assumed by the firm.

Second Party Logistics (2PL). Carriers providing a transport service over a specific segment of a transport chain. It could involve a maritime shipping company, a rail operator or a trucking company that are hired to haul cargo from an origin (e.g. a distribution center) to a destination (e.g. a port terminal).

Lynn Failing explains, “Let’s try a different picture. Not layers of a cake. More like slices in a pie. A 3PL offers one slice of service. 4PL’s combine two or more service offerings in a ‘one slice solution’ package. A 4PL could combine international freight and deconsolidation services. Or any other two.

“To make it even more complicated, most large global 3PLs, like FedEx, UPS and DHL, also sell integrated 4PL services. As 4PL’s ‘bundle’ service offerings, they also can – and often do – ‘unbundle’ their 4PL co-ordination role, just to sell a single service to a customer.”

3PLs vs. 4PLs – The Difference

Learning the difference between a 3PL providers and 4PL providers and as well as 1PL and 2PL and the rise of even a 5PL is both confusing and highly debated among experts in the supply chain industry.

The generation of 4PLs is evolving and advancing to an extent from the legacy of 3PLs work scope with specific themes created to address value-added require-ments with clients’ partnership.

The basic concepts of 3PLs are here to stay (specifically asset-based providers) and the evolution to extend services as a 4PL will be the deciding factor many shippers (small companies or large multi-national companies) stand on in their selection of a provision partner.

Naturally, we do see spin-offs again, from a 4PL pint-of-view, whereby some retain specialty in specific knowledge & skill-sets (i.e. IT / MRP / direct & indirect sourcing etc.), but yet there are many of the 4PLs who would be entrenched in the general provisions as “3PL managers” to co-ordinate the overall fulfillment processes B2B2C ultimately,” according to Adrian Chen, an Advisory Board Member (Asia Pacific) at ISCEA Internal Supply Chain Education Alliance.

Failing of Kimmel Associates, said, “Whenever a company outsources all or any part of its logistics or transport functions to another company, this company is using a ‘third party’ to do this function. 3PL’s come in all shapes and sizes, and they perform a whole variety of outsourced logistics functions for a company: customs clearance, international freight movement, inbound and outbound transportation, warehousing, cross-docking, fulfillment and even reverse logistics.

“4PL emerged because some 3PLs in the marketplace offer more than one outsourced logistics function. By combining these service offerings from a single source, these companies became known as Fourth Party Logistics Providers or 4PLs”.

Also referred to as the Leading Logistics Provider (LLPs), 4PLs have a broad role within the supply chain. They assume many of the similar roles as 3PLs but have a much broader responsibility and accountability in helping the client reach its strategic goals.

Accountability and control help differentiate a 3PL from a 4PL, according to Penske Logistics, “As a 4PL we become a trusted advisor and the customer becomes reliant on our data to drive them forward,” said Penske Logistics Senior Vice President Any Moses.

Working together

When a 3PL transitions to a 4PL, it changes the type of information the provider may access. Transparency is key for 4PLs that may also function as a 3PL. They must proactively work with customers to demonstrate the checks and balances they put in place, such as creating confidentiality agreements that prohibit the sharing of information and data from the customer’s other 3PLs and transport- ation providers.

“Transparency is both essential and inevitable. 3PLs typically act as ‘sub-contractors’ through the 4PL. This means that, real-time transparency is built into a seamless EDI link, which links all the parties. Ask anyone involved in an EDI rollout. It’s always a challenge, but worth every bit of money and sweat you put in, when your client sees it at work,” adds Failing.

3PLs and 4PLs operate the same way but consist of different parts. A 3PL company arranges freight carriers and warehousing by dealing directly with the service providers. A 4PL company, on the other hand, arranges the same services and more for a client but does so by employing companies such as 3PL companies, who use their vast network of carriers and warehousing providers.

4PL companies manage these 3PL companies and other companies to provide a client with a comprehensive, end-to-end supply chain.

“Preferably, these services are integrated, or ‘bundled,’ together by the provider. Services they provide transportation, warehousing, cross-docking, inventory management, packaging and freight forwarding.

In 2008, the United States passed legislation declaring that the legal definition of a 3PL is ‘A person who solely receives, holds, or otherwise transports a consumer product in the ordinary course of business but who does not take title to the product.

“It is possible for a major third-party logistics provider to form a 4PL organization within its existing structure,” says Failing.

However, a 4PL is neutral and will manage the logistics process, regardless of what carriers, forwarders, or warehouses are used. The 4PL can and will even manage 3PLs that the customer is already currently using. Many 4PLs have addressed the huge requirements of electronic interface between numerous companies.

Tuning the supply chain

The supply chain management (SCM) profession has continued to change and evolve to fit the needs of the growing global supply chain. With the supply chain covering a broad range of disciplines, the definition of what is a supply chain can be unclear.

Supply chain management is an integrating function with primary responsibility for linking major business functions and business processes within & across companies into a cohesive and high-performing business model. It includes all of the logistics manag-ement activities noted above, as well as manufacturing operations, and it drives coordination of processes and activities with and across marketing, sales, product design, finance, and information technology.

“4PLs’ promise and generally deliver solutions which are more ‘systemic’ for their customers, usually resulting in higher efficiencies, simplified reporting and improved analytics by optimizing supply chain flows throughout the ‘purchase-to-pay’ or the ‘order-to-cash’ cycle for their customers,” notes Failing.

Digitally optimizing the supply chain

The increasing digitization of freight transportation is opening the door to a new kind of management company within the supply chain: the 4PL.

Third-party logistics (3PL) providers have been successfully managing companies’ operations for years. But with new data streams and techno-logies such as blockchain that will allow disparate systems to operate in a single, unified and trusted chain, the rise of the 4PL may be upon the industry.

The introduction of 4PLs are not new – they have been around for some time – but their mainstream use is growing, due in large part to advances in technology.

“All 3PLs and 4PLs use increasingly sophisticated technology platforms to serve their customers better. For example, Transportation Management Systems. In addition, 3PLs and 4PLs also offer an electronic data interface (EDI) which allows their customers visibility into whether it’s freight tracking,” Failing said.

Previously, different software systems and goals made it difficult for one party to control an entire supply chain. That is changing.

When asked if 4PLs or other PLs would replace each other in the future Failing replied, “Absolutely not. There will always be room for ‘niche’ players, which can provide unique value in particular industry verticals or geographies. However, the continuing changes means that M & A activity will continue to be lively in this sector in the coming years”.

Furthermore, Lynn Failing believes the future of 4PLs is “bright” as 4PLs offer more complex and integrated “one stop” solutions for manufacturers, retailers and trading companies around the world.