Air freight bounces back in new pace and time

2017 is a robust year for both passenger and cargo volumes despite economic and political challenges across the world.

By the end of this year, a record 4 billion people would have traveled in different regions, sprucing up freight belly statistics in the process, analysis points out.

Technological advancements have tremendously contributed to the growth of commercial civil aviation with many passengers taking control of their own itineraries through online bookings, cutting travel agencies in the process to save money and time. Add to that is the emergence of more Low Cost Carriers (LCCs) which give them cheaper fare options as opposed to legacy carriers.

The rise of the social media, which changes the way how airlines and other companies reach out to their target markets, also significantly contribute to this phenomenon.

The Kingdom of Saudi Arabia’s newly-launched budget airline, flyadeal, booked 10,000 seats online within 24 hours without any print ads, its CEO Con Korfiatis announced at the recently concluded Aviation Show MENASA (the Middle East, North Africa and South Asia), a remarkable feat given the reclusive kingdom’s conservative policies on many things digital.

“Digitalization is driving innovation and disruption at an ever-increasing pace in all kinds of industries, and therefore for all users of airfreight. This is putting unprecedented pressure on all of us to redouble and accelerate our efforts to transform, adapt, and streamline processes in concert with regulators.”

– Oliver Evans, former chairman of the International Air Cargo Association

Elsewhere in the Middle East, where more than half of the population are below 25, the digital footprint of online bookers are growing, with many opting online transactions for safety and security reasons.

Opposite Profit Margins

But while passenger volumes are up, the profit margins of airlines are getting thinner for many different reasons.

It’s the reverse, however, for the air freight industry which adjusts prices as demand grows, especially during the holiday season or Valentine’s Day.

Muhammad Al Bakri, regional SVP AME International Air Transport Association (IATA), said at the Arab Air Carriers Association Annual General Membership held last month in Sharjah, one of the emirates in the UAE, aviation remains the beating heart of the Middle East supporting 2.4 million jobs and USD157 billion in economic activity but times are changing.

“As history shows, it is not unusual for freight volumes to continue to rise even after the peak of the growth cycle. Indeed, periods in which freight volumes have fallen typically only occur alongside wider shocks to global economic and trade conditions, such as that seen following the dot-com boom in the early-2000s and after the global financial crisis. In the absence of such a global shock, it seems reasonable to expect that air freight volumes will build on a very strong 2017 with another year of solid growth in 2018.”

– IATA

“Financially, airlines in the region are seeing their profits eroded and margins squeezed. The average profit per passenger globally in 2017 is forecast to reach 7.7 US dollars. In the Middle East, it is only expected to reach 1.8 dollars per passenger,” he noted.

Statistically, Al Bakri said global aviation generates 3.5 percent of the world’s GDP valued at about USD2.7 trillion and supports 62.7 million jobs.

In addition, 35 percent of world trade worth US6.4 trillion is transported by air annually.

With high volumes of gifts sent this holiday season, the air cargo industry is at its busiest with shippers scrambling for space and customers willing to pay more.

Freightos WebCargo data shows air freight prices in certain locations have already risen by over $1 per kilo yet the demand for e-Commerce shipments keeps on rising.

Experts said e-Commerce and pharmaceutical shipments will be an important driver for the growth of the air freight industry now and in the long-term.

Global e-Commerce is projected to grow from USD1.9 trillion in 2016 to $4.5 trillion in 2021 with 19 percent annual compound growth rate over the next five years, according to the leading aviation consultancy firm Air Cargo Management Group.

Allan Hedge, senior director of ACMG, said E-commerce has disrupted retail and is now revolutionizing logistics and the air cargo industry.

In a separate report, Boeing forecast e-Commerce to grow from USD1.7 trillion in 2016 to USD3.6 trillion by 2020, largely fueled by the growth of the middle-class in the Asia-Pacific region, most notably China, the world’s largest e-Commerce market with some USD590 billion goods sold in 2015.

Boeing said the online retail trade will, thereby, push growth in the air cargo industry as consumers prefer fast shipments of goods.

New Pace & Phasess

Though slower than commercial aviation in embracing technological developments, the air cargo industry has undoubtedly adjusted to the times with many companies investing on new software solutions and technology where shipments can easily be placed and tracked, costs calculated in an instant and even options for land connectivity.

In today’s fully globalized world, the need to connect in an instant is paramount in doing business, especially where movement of goods are concerned.

“The ability to electronically exchange air waybills, house bills and status messages enables our customers to further automate and streamline processes, meet expanding carrier electronic communications requirements, increase visibility and improve performance. Customers benefit from simple and fast activation on Descartes’ GLN from CDM Software Solutions’ e-Commerce friendly software platform,” explained Darrell Ortiz, CEO and founder of CDM, on the importance of Descartes’ GLN which also provides users with connectivity to air carriers around the globe to help them meet IATA’s electronic air waybill (e-AWB) initiative.

Nagarjun Peri, Kale Logistics Solutions regional manager for international sales in the Middle East and Africa, said today’s business climate demands speed, efficiency and transparency and all that can only be provided through customized software solutions.

The India-based company has more than 500 clients across the world, including about 200 airlines, which are also linked to air cargo carriers and freight forwarding companies.

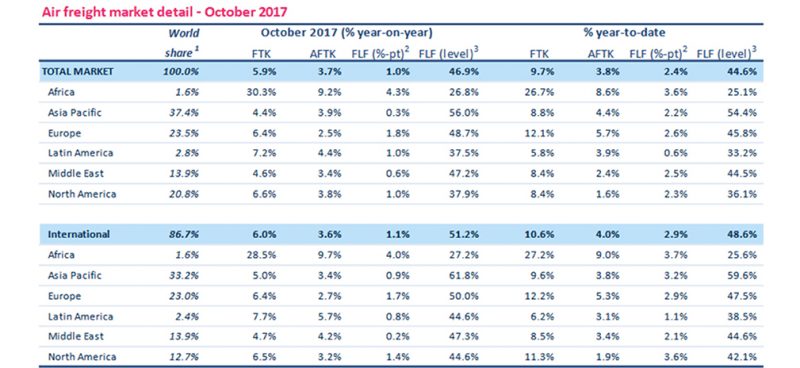

Air cargo volumes consistently posted positive growth month-by-month in 2017. In October, shipments were up 5.9 percent and IATA forecast the freight volumes to continue rising in 2018.

“Going in to next year, the cyclical drivers of freight demand appear relatively supportive of continued increases in freight volumes. In fact, factors such as the long-awaited pick-up in investment in Europe, as well as reports of strong growth in international e-commerce flows look set to help underpin freight demand in the near term,” IATA said in its October 2017 analysis report.

“As history shows, it is not unusual for freight volumes to continue to rise even after the peak of the growth cycle. Indeed, periods in which freight volumes have fallen typically only occur alongside wider shocks to global economic and trade conditions, such as that seen following the dot-com boom in the early-2000s and after the global financial crisis. In the absence of such a global shock, it seems reasonable to expect that air freight volumes will build on a very strong 2017 with another year of solid growth in 2018,” it added.