Xeneta Analysis Predicts New Growth Cycle for Global Air Cargo Industry in 2024

2024 may herald the start of a new economic growth cycle for the global air cargo industry after last year ended with a +9% year-on-year rise in demand and the general air cargo spot rate reached its highest level in nine months, suggests the latest weekly market data analysis by Xeneta.

While the geopolitical environment and cost of living pressures continue to present significant hurdles to global trade, the predictability of air cargo means the industry stands to benefit from escalating international disruption, albeit producing only modest gains in volumes, says Niall van de Wouw, Xeneta’s Chief Airfreight Officer.

He said: “To say 2024 is a ‘new dawn’ is perhaps a litte too optimistic, but I certainly think it’s the start of a new cycle for airlines and forwarders – and shippers are likely to also appreciate the stability returning to the market so they can more accurately predict the transporation costs for the products they are selling.”

Weekly market data for December shows the global average air cargo spot rate peaking at USD 2.60 per kg, up +6% on its November level, boosted by a +9% annual growth in demand. The general air cargo spot rate, however, continued to record a double-digit year-on-year fall of -18%. This compares to a growth ratio of -25% in November compared to the previous year.

“December 2023 data shows the market was slightly busier than anticipated, but we shouldn’t be tempted to draw too many conclusions from what happens in the final month of the year because the Christmas and New Year holidays make it an odd month.

“We also need to factor in that December 2022 provided a low comparison base given the very muted demand seen 12 months ago. This latest data appears to reflect stronger but temporary local market performance on key lanes as opposed to signaling a global economy that is doing much better. Our market outlook forecast for 2024 remains unchanged with an anticipated +1-2% growth in demand, and a +2-4% rise in supply,” he said.

As the heightened cost of living permeates advanced economies, consumers opted for more discounted e-commerce shopping to fulfil their Christmas shopping lists, adding to export volumes especially from Asia. However, it is worth noting that general retail sales outside of e-commerce remained subdued, especially when adjusted for inflation.

Looking at market supply, December global air cargo capacity stayed at a similar level to previous months, climbing +6% year-over-year versus the global supply still under recovery in 2022.

The global dynamic load factor, Xeneta’s market performance indicator which measures air cargo capacity utilization by considering both cargo volume and weight perspectives of cargo flown and capacity available, dropped to 59% in December. This was 1 percentage point down from its November level, but 3 percentage points higher than in December 2022 as year-on-year demand growth outperformed the increase in cargo capacity.

Prime regional lanes performed strongly in the final month of 2023.

The general air cargo spot rate from Europe to the US stood at USD 2.42 per kg in December, up +21% month-over-month. The reduction in capacity helped to push up rates on this lane. Similarly, corresponding spot rates from China and Southeast Asia to Europe both rose +9% to USD 4.49 per kg and USD 2.91 per kg respectively.

The crisis impacting ocean container shipping in the Red Sea and disruption through the Suez Canal has yet to influence air cargo rates as the surge of air cargo demand for the holiday season was close to its end by the start of these events.

Triggered by strong e-commerce demand, the China to the US air spot rate rose another +6% in December to USD 5.12 per kg. In line with this, the airfreight spot rate ex Southeast Asia to the US climbed +14% to USD 4.50 per kg as outbound Southeast Asia shipments tend to transit via other Asian countries before heading into the US.

The China to the US corridor was the only lane among those referenced to see its December air cargo spot rate climb above its December 2022 level, up +13%. But similar to these other corridors, the air cargo spot rate on this corridor mostly peaked in early December. By the week ending 31 December, the China to US spot rate fell by a considerable 20% to USD 4.54 per kg from its peak three weeks earlier.

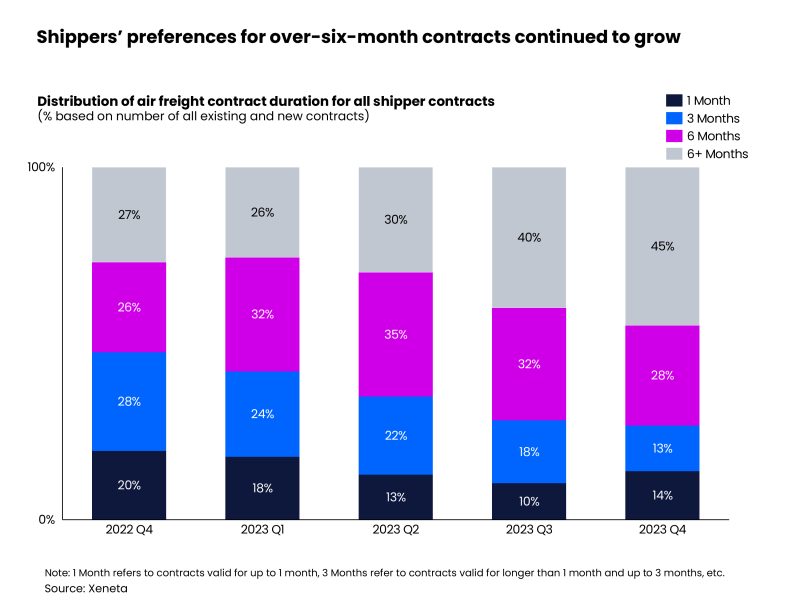

With rising expectations of market normalization, more shippers preferred to commit to longer-term, fixed rate contracts in the last quarter of 2023. Over-six-month contracts accounted for 45% of the total contracts signed, up 5 percentage points from the previous quarter. Six-month contracts amounted to another 28% of the total market. This was in stark contrast to the pandemic era when most shippers had to manage rates valid for up-to-one-month only. By the fourth quarter, the share of up-to-one-month rates was only 14%.

Niall van de Wouw added: “There’s still a lot of friction in the global supply chain market and that means there will be opportunities for some sectors. If big ocean carriers are not going through the Red Sea, it might delay a million or more containers, with all the knock-on effects. And the fact that you don’t know how long this situation will continue means some shippers will pay for the predictability of air cargo to lessen the impact of the current ocean freight disruption.

“In contrast, air cargo seems to be in a more ‘steady state’. It is important for airlines and forwarders to focus on the elements they can control, such as cost and reliability, and to be ready for when the opportunities arrive.”

Van de Wouw also questioned whether ocean carriers will continue to invest their profits from the pandemic to get a stronger foothold in the air freight market?

“The overall outlook for supply chains in 2024 remains very difficult to forecast amidst all this market uncertainty. This is generally not good for investments and shippers/consumers alike, but it might be good for airfreight’s share of global trade,” Van de Wouw continued.

“At Xeneta, we’re trying to help our customers avoid gambling on what the market rates will do. We are supporting them with spending less time on trying to predict what rates will do, and more time on working with a pricing mechanism that can deal fairly with these market fluctuations.”