Rate surge continues throughout May from Middle East & South Asia

Air cargo rates from Middle East & South Asia (MESA) continued to surge throughout May, with spot rates from MESA origins to Europe averaging more than twice their level in May last year, while tonnages and rates from Asia Pacific origins were also well above last year’s levels, according to the latest weekly figures and analysis from WorldACD Market Data.

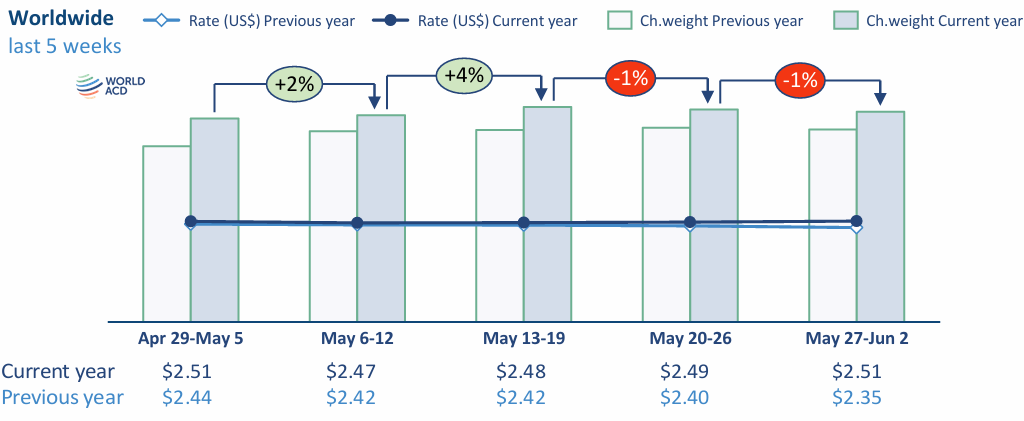

It covers each of the last 5 weeks up to Sunday June 2, 2024.

Amid continuing strong demand, and disruptions to ocean freight services caused by the attacks on container shipping, average air cargo rates in May of US$2.78 per kilo from MESA to worldwide destinations were up +47%, year on year (YoY), with tonnages +17% higher, based on the more than 450,000 weekly transactions covered by WorldACD’s data. And from MESA origins to Europe, May’s average spot rate of around US$3.35 per kilo was more than double the level in May last year, with the average spot rate in week 22 (27 May to 2 June) up by +128%, YoY.

Elevated spot prices from India

Those average rates are being boosted by highly elevated spot prices from India to Europe ($3.78 per kilo, +160%) and Bangladesh to Europe ($4.38, +189%), although spot rates from Sri Lanka and Dubai have also been on an upwards trajectory for most of this year, standing at $2.95 and $2.28 per kilo, respectively, in week 22 – almost twice last year’s equivalent levels. Including contract rates, overall average rates in May from MESA origins to Europe were up by +77%, YoY.

Meanwhile, Asia Pacific origins recorded a +21% rise in tonnages in May, YoY – their highest YoY growth since January – while rates from Asia Pacific origins recorded their first significant YoY full-month rise this year, up by almost +12%.

Global demand recovery

Despite falling rates from other regions, this strength in Asia Pacific and MESA origin traffic helped keep overall average global rates steady in week 22 at a worldwide average of US$2.51 a kilo, which was up around +1%, week on week (WoW), and up around +7%, YoY – and significantly above pre-Covid levels (+42% compared to May 2019). And preliminary full-month figures indicate that global average overall rates in May were up by +3%, YoY, with chargeable weight up by +13%, YoY.

Examining the last two full weeks, tonnages in weeks 21 and 22 were flat on a global basis compared with the previous two weeks (2Wo2W), with increases from Asia Pacific (+2%), Europe (+1%) and MESA (+1%) origins wiped out by falling tonnages from North America (-5%) mainly due to Memorial Day (Monday 27 May), Africa (-3%) and Central & South America (-3%). But tonnages in weeks 21 and 22 were up significantly from all the main regions on a YoY basis, including a +16% rise from Asia Pacific origins that raised the global average increase to +9%, YoY.

Globally, there was a mixed picture on the pricing side in weeks 21 and 22, with increases from Asia Pacific and MESA origins driving a +1% increase compared with the previous two weeks, and a +5% rise, YoY.