Global commercial helicopter market valued at $8.2b, predicts IBA

IBA, the independent aviation consultancy is experiencing increasing interest in the helicopter sector. There are more investor enquiries, rig utilization is increasing, and interest in the super medium sector all point to a more buoyant market.

The global commercial helicopter market was valued at US$8.2 Billion in 2017 and it is expected to increase to US$11.6 Billion by 2027. Key factors expected to drive the market for commercial helicopters aside from offshore oil and gas include rising demand from emerging economies in Asia Pacific, Middle East, and Latin American markets, along with increased utilization of existing helicopters across many different sectors like emergency services, law enforcement, para public and corporate transport and tourism.

According to IBA there are over 33,000 helicopters operational today counting both piston and turbine engine driven aircraft. The majority of commercially driven operators fly turbine helicopters. Out of around 22,000 turbine helicopters, the majority (90%) are owned by the operators and 10% leased.

From the start of 2017 onwards there has been some evidence of a recovery and numbers are increasing. Oil, currently at circa $70/bbl, has crept back into the value that will interest operators. Viability of deep-water offshore oil production is about $80/bbl. Sources estimate that between $50/bbl to $65/bbl will spark exploration back up again. However, IBA has noted that it normally takes the industry two years to recover sufficiently following an increase in oil prices. This particular downturn is unique however, as IOCs/NOCs/helicopter operators have had to get more creative; tightening operations to stabilise costs/margins. This is likely to continue and a new, lower, equilibrium point will be established.

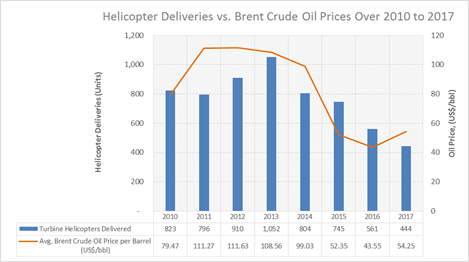

The overall trend of deliveries in the helicopter market closely follows the price of oil – as offshore oil & gas operations (OSOG) is one of the biggest demand drivers for the technology, albeit delayed by 1 to 2 years. It is worth noting that after the oil price plummeted in 2014/2015, helicopter deliveries have followed suit. The most pronounced decreases have been seen in the heavy and medium helicopters category, which primarily serve the OSOG market. Deliveries have also been affected by the slowdown in investor confidence.

While almost 50% of fixed wing aircraft fleet are leased to the operator, in the commercial helicopter industry this is closer to 10-20%. IBA observes that the demand for commercial helicopters is expected to be driven by leasing companies buying significant numbers of new and advanced helicopters to renew their fleets to serve the rapid expansion of major helicopter operators. Over the next decade large manufacturers such as Russian Helicopters and Airbus Helicopters will be continuing research and development efforts to compete in the highly competitive helicopter marketplace. Speed and weight are important factors that affect helicopter performance and dramatically impact operational viability and profitability. The current focus by OEMs is on faster, larger, and ever more reliable helicopters for diverse industry applications and developing economies.

In terms of categories, IBA predicts that the market will be dominated by the medium helicopters segment, which will account for 55%, followed by the light and heavy segments with shares of 35.4% and 9.6%, respectively. North America is expected to dominate the sector with a share of 35.2%, followed by AsiaPAC, with a share of 27.9% and Europe with 27.4%. The super medium helicopters also appear to be establishing a firm place in the market.

The delivery of helicopters as a percentage of existing fleets at the six specific continental regions shows that Asia clearly takes the lead observes IBA. The base helicopter fleet in Asia is growing and China is taking the lead in this area. Since the rescinding of a flight ban by Chinese authorities in 2013 which forbade commercial aircraft flights operating below 1,000m, there have been 450 helicopters delivered. This is in line with predictions that there would be 1,500 helicopters delivered to China within a ten year period of the restrictions being lifted. It is clear that Asia (including China) has been expanding faster and more quickly than any of the other regions for 70% of the time since 2007.