Air Cargo Growth Slows in January

Worldwide air cargo recorded a 2% year-on-year (YoY) tonnage increase in January, significantly below last year’s 11% average growth. The slowdown is attributed to tougher comparison figures, moderating e-commerce volumes, and an earlier-than-usual Lunar New Year (LNY) in East Asia.

Tonnage Drops in Late January

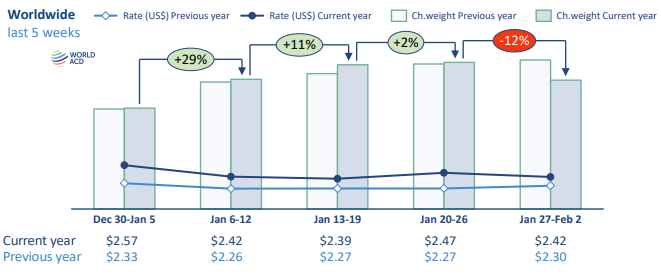

According to WorldACD Market Data, total worldwide tonnages dropped by 12% in week 5 (Jan. 27 to Feb. 2), week on week (WoW), after rebounding from the seasonal end-of-year slump. This decline was driven by a 33% drop in chargeable weight from Asia Pacific origins due to factory closures for LNY, which occurred on Jan. 29 this year, compared to Feb. 10 last year.

Regional Variations in Cargo Volumes

The 33% WoW drop from Asia Pacific was partially offset by increases from Central & South America (+16%) and Africa (+11%), boosted by flower volumes ahead of Valentine’s Day, and a 4% increase from North America. Despite these gains, total worldwide tonnages in week 5 were down 14% compared to the same week last year.

January Tonnage and Rate Trends

On a full-month basis, January tonnages from Asia Pacific were up 3% YoY, with increases also from North America (+5%) and Central & South America (+2%). Overall, global rates for January averaged $2.44 per kilo, up 7% YoY, with significant increases from MESA (+33%), Asia Pacific (+10%), and Africa (+10%).

Read: Oman Air Cargo Extends Partnership with Jettainer

Price Trends and Regional Spot Rates

Average worldwide air cargo prices in week 5 fell by 2% to

3.87 per kilo, 21% higher than last year. MESA spot rates increased 4% WoW, now 58% above last year’s levels. Africa saw a 14% WoW rise, lifting rates 25% YoY. North America was the only region with lower spot rates than last year (-5% YoY).

Uncertain Outlook for China-US Market

The suspension of China’s access to the USA’s ‘section 321’ customs-free entry process may impact the China-US e-commerce market.

Analysts expect the effects on air cargo to become clearer in the coming weeks, although LNY impacts may obscure the data.

China to Europe tonnages fell 28% WoW, while China to USA volumes dropped 21%. However, China to Europe spot rates held steady, dropping just 1% WoW, compared to an 8% WoW fall for China to USA rates.