Air Cargo Growth Softens in Early 2025 - WorldACD Market Data

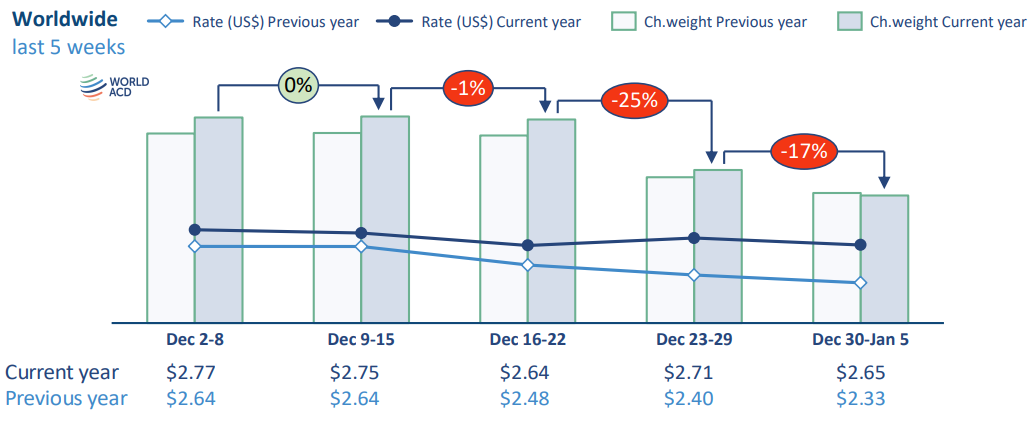

Worldwide air cargo began 2025 with softened growth in both tonnages and rates, according to WorldACD Market Data. December’s global tonnages were approximately 6% higher than the same month in 2023, but this represents the lowest year-on-year full-month growth, as average full-market rates increased by 7% YoY, half the growth reported in September.

Tonnage growth for November and December softened to single-digit figures, possibly indicating a new, more moderate growth trend. “This does not come as a surprise,” WorldACD noted, as Q4 2023 showed strong growth, creating a higher base for comparison.

In the first week of 2025, total worldwide air cargo tonnages recorded only a 2% YoY growth, influenced by seasonal drops and severe weather conditions, particularly in the U.S. Average global spot rates started the year 22% above their levels a year ago, driven by a 23% increase from Asia-Pacific origins and a 59% rise from Middle East & South Asia (MESA) origins.

Demand from Asia Pacific remains strong, but the g

Asia Pacific Demand (WorldACD Market Data)

rowth rate is decelerating. December’s full-month data showed a slight drop in worldwide chargeable weight, with a 3% decrease compared to November. This was largely due to a 6% month-on-month decrease from Europe and a 2% decrease from Asia Pacific origins.

Read: Chapman Freeborn Appoints Bolton-Wilson as VP in Americas

Despite this, tonnages from Asia Pacific origins in December were significantly higher than most of 2024, reflecting a ramp-up in the final months. Quarterly data showed a 6% increase in Q4 2024 compared to Q3, and an 11% increase compared to Q4 2023.

The YoY worldwide demand growth pattern softened in Q4 2024, with total worldwide flown chargeable weight up 8% YoY, compared to 12% in the first two quarters. Growth from Asia Pacific origins drove these increases, with YoY quarterly growth softening from 20% in Q1 to 11% in Q4.

Transatlantic westbound rates soared in the final months of 2024, with spot rates from Europe to North America up almost 50% year-on-year in December. They peaked at 2.95 per kilo in the final week, still reflecting a 44% year-on-year increase.