China-Europe Air Cargo Tonnages Rebound Post-Golden Week

Air cargo tonnages from China to Europe have broadly recovered to their levels prior to China’s Golden Week holiday at the start of October, while tonnages from Hong Kong to Europe have risen further in the last six weeks to their highest level this year, indicative of a possible ramping up of e-commerce and wider demand from this key origin market in the final months of the year.

According to the latest weekly figures and analysis from WorldACD Market Data, Hong Kong to Europe tonnages in week 42 (14 to 20 October) were +25% higher than their already strong levels in the equivalent week last year. And Hong Kong to Europe tonnages in weeks 40-42 were +12% higher than their average weekly levels in September.

On the pricing side, average spot rates from Hong Kong to Europe in the last seven weeks have risen above the US$5 per kilo level, fluctuating between $5.04 and $5.31, and standing at $5.15 in week 42, with China to Europe spot rates rebounding to $4.29 per kilo, taking both to around +13% above last year’s levels. But there have been some bigger year-on-year (YoY) increases from some other Asia Pacific markets – particularly on the pricing side.Other Asia Pacific markets showing significant YoY tonnage increases to Europe in week 42 include Thailand (+27%) and Vietnam (+26%). But spot rates from those two markets to Europe were up, YoY, by +87% and +61%, respectively, in week 42, based on the more than 450,000 weekly transactions covered by WorldACD’s data.

The consistent strengthening of the Hong Kong to Europe market in the last six weeks, despite the normally dampening effects of China’s Golden Week holiday period at the start of October, is one of the earliest and only indicators of a potential significant fourth-quarter (Q4) air cargo peak season emerging this year.

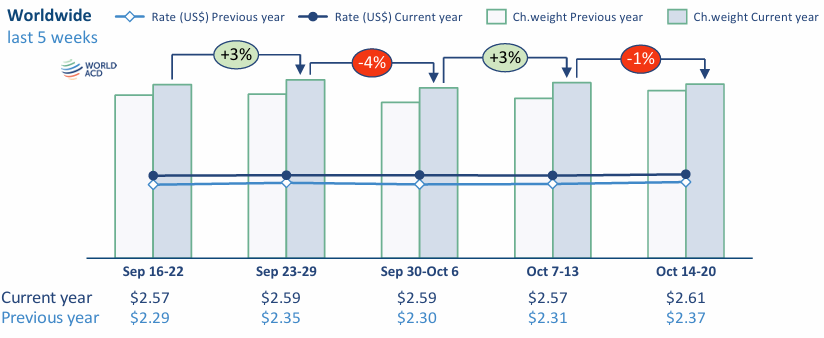

On a worldwide basis, average global rates edged up only slightly in the second full week of October and tonnages nudged downwards from most of the major regions – the biggest decline coming from Middle East & South Asia (MESA) origins. But the patterns in week 42 this year are similar to those of last year, with tonnages having broadly recovered from the effects of China’s Golden Week holiday at the start of October, and poised for a potential surge in the final weeks of the year, as occurred last year.

Fall in tonnages from MESA

Following a moderate (-4%) WoW fall the previous week, tonnages from MESA to Europe dropped by a further -8% in week 42. More than half of that decline was due to a drop in chargeable weight from Dubai to Europe (-22%, WoW), although there were continuing declines also from Bangladesh and Sri Lanka origins to Europe. A two-week-on-two-week (2Wo2W) comparison, comparing the combined figures for weeks 41 and 42 with those of weeks 39 and 40, also results in a -8% drop in tonnages from MESA to Europe. This drop is most likely a reflection of the recent impact of the increased military and geopolitical tensions in the region.

Meanwhile, tonnages from MESA to the USA were also down by -6% in week 42, with tonnages falling from India (-3%) and with consecutive weeks of double-digit percentage declines to the USA from Bangladesh and Sri Lanka origins. Average spot rates from MESA to the USA have also fallen in recent weeks from US$5.02 in week 40 to $4.69 per kilo, a drop of almost -7%. However, they are still +80% higher than this time last year.

On a worldwide basis, tonnages in week 42 slipped -1% compared with the previous week, taking them just +4% above their levels this time last year, with all the world’s main origin regions ahead by between +2% and +5%, YoY. And average global rates edged up by a further +2%, WoW, taking them +10% above last year’s levels – based on a full-market average of spot and contract rates. Spot rates are up +19%, YoY, driven by the continuing big YoY increases from MESA (+82%) and Asia Pacific (+25%). And on a 2Wo2W basis, worldwide tonnages and rates were both stable, leaving tonnages up, YoY, by +7%, and rates by +11%, YoY.

China-USA tonnage slump continues

Asia Pacific to USA total air cargo tonnages continued their recovery in week 42 from the effects of China’s Golden Week holiday, rebounding by a further +4%, WoW, thanks to a +10% WoW increase from China. But compared with last year, China-USA tonnages remain significantly down (-18%, YoY) – part of a wider pattern of decline in China-USA tonnages in the second half of this year. That decline appears to have been triggered by tighter Customs rules and checks since July on inbound USA air cargo traffic from China, especially at Los Angeles (LAX). Indeed, China to LAX tonnages in week 42 were down by -37%, YoY.

However, spot rates from Asia Pacific to the USA, and from China to the USA, rebounded by a further +3%, to $6.23 per kilo and $5.41 per kilo, respectively – taking Asia Pacific-USA spot rates +42% above their equivalent levels last year, and taking China-USA spot rates +10% higher, YoY.