Paris Air Show returns after four years with eyes set on SAF & eVTOL

India dominates the world’s largest air show with 970 plane orders. Over $150 billion worth of contracts signed at the event but not much activity on air freight industry.

By R. Chandrakanth

After a four-year hiatus due to the pandemic, the International Paris Air Show (PAS), the largest air show in the world held since 1909, returned this year with a bang.

The event which ran from June 19-22, 2023 was held at Paris–Le Bourget Airport in France, its home since 1953.

India stole the show on the first two days, placing record-breaking orders in the history of commercial aviation. On Day 1, India’s low-cost carrier, IndiGo made a whooping order of 500 Airbus aircraft and on Day 2, Air India formally inked the purchase agreement for 470 aircraft, 250 from Airbus and 220 from Boeing. Indeed, it was India’s moment.

Airbus had in its kitty 821 aircraft and Boeing 356 aircraft from the 54th edition, reiterating the strength of the emerging South-Asian market. Besides these two orders, there were orders galore for all innovations in aerospace and defence and the organisers, SIAE (Le Salon International de L’Aeronautique et de L’espace) were pleased as punch that the show saw approximately $150 billion worth of contracts signed.

On the home-turf, Airbus Chief Executive Guillaume Faury, who heads France’s aerospace industry association GIFAS, called it “the return of the good old times of the excitement of the show”.

Over 3,00,000 visitors

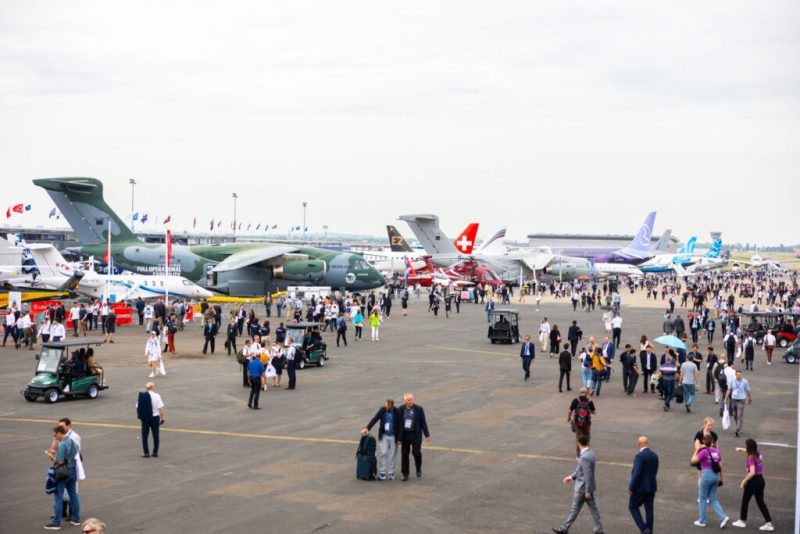

The iconic show, which some termed as a ‘recovery show’ was inaugurated by French President Emmanuel Macron, drawing over 3,00,000 visitors; 2,500 exhibitors from 46 countries; 3,000 Start-ups from 21 countries; and 150 aircraft on display, both aerial and static, but no freighter aircraft.

Apart from the huge airplane orders, PAS will be remembered for the overwhelming display of electric vertical take-off and landing (eVTOL) aircraft and for the continued focus on moving towards net zero by 2050.

In sync with the innovations and the need to go carbon neutral, the French President announced $2.2 billion to help develop technologies to reduce aircraft emissions which is said to account for less than 3 percent of global CO2 emissions.

Urban Air Mobility takes centre-stage

Indeed, Urban Air Mobility (UAM) took centre-stage with so many prototypes on display and moving towards certification and commercial launch. By next year, when the Olympics and Para-Olympics take place in Paris, Volocopter, the pioneer of UAM, is going all out to ensure that Paris will be the first European city, and most likely the first city in the world, to offer eVTOL.

As many as a dozen eVTOL manufacturers showcased their innovations. California-based Overair’s prototype Butterfly eVTOL aircraft is in the process of getting air operator certificate to launch services that include emergency medical flights and cargo deliveries.

The Paris Air Mobility zone which had the UAMs on display was chock-a-block with aviation enthusiasts and the companies Archer, AutoFlight, Lilium, Volocopter, Wisk Aero, Supernal, Ascendance Flight Technologies, EHang, Eve, and Joby were as excited to present their innovations.

The Paris Air Mobility Hall was a testimony to the fact that innovators are thinking of electric aviation in the larger perspective – staying safe, being extremely environmentally conscious, and mobility to address the needs of cities which are fast bursting at their seams now.

SAF update

The Le Bourget show was also a platform to focus on sustainable aviation fuel (SAF) with several stakeholders giving updates on their programmes. France took the lead when it announced, a few days ahead of PAS, that it was making EUR 200 million investment for the advancement of SAFs in France.

On Day 1 of PAS, Total Energies announced investment of over EUR 700 million in production of SAFs. Patrick Pouyanné, Chairman and Chief Executive Officer of Total Energies, stated “Total Energies is taking action to meet the strong demand from the aviation industry to reduce its carbon footprint. Sustainable aviation fuel is essential to reducing the CO2 emissions of air transport, and its development is fully aligned with the company’s climate ambition to get to net zero by 2050, together with society.”

Total Energies stated that “Beyond France, Total Energies aims to produce 1.5 million tons/y of SAF by 2030 at production units in Europe, the United States, Japan and South Korea, representing 10% of the world market by that date.”

Boeing launches tool to track SAF capacity

Boeing also launched SAF Dashboard, a tool that tracks expected SAF capacity over the next decade. Based on data collected by BloombergNEF, the Dashboard aggregates total SAF capacity announcements by suppliers on a global scale and can filter anticipated supply by production pathway, location and other metrics. The tool is accessible on Boeing’s new Sustainable Aerospace Together hub.

Boeing released the tool to support discussion and action among industry stakeholders regarding the existing SAF footprint as well as future production levels required to meet the commercial aviation industry’s goal of net-zero emissions by 2050.

“SAF reduces CO2 emissions by up to 85% and possibly more over the fuel’s life cycle, offering the greatest potential to decarbonize aviation over the next 30 years,” said Boeing Chief Sustainability Officer Chris Raymond. “SAF Dashboard portrays the data visually as our industry works together across sectors to increase SAF production for a more sustainable aerospace future.”

The release of SAF Dashboard comes after Boeing in May launched the public version of the Boeing “Cascade” Climate Impact Model, a data modelling tool that identifies the effects of a range of sustainability solutions to reduce aviation’s carbon emissions.

Passenger movement up, cargo slow

Coming back to the airline industry, the show offered signs of optimism for aircraft manufacturers, though the industry still has a long way to go for complete recovery from the devastating effect the pandemic has had.

The International Air Transport Association (IATA) estimated some 4.35 billion people will travel by air in 2023, which is closing in on the 4.54 billion who flew in 2019. Similarly, cargo volumes are expected to be 57.8 million tonnes, which has slipped below the 61.5 metric tons carried in 2019 with a sharp slowing of international trade volumes.

Air India and IndiGo orders have significantly buoyed confidence levels in the industry. Airbus Chief Commercial Officer Christian Scherer, said: “This market (South Asian) is going to feed a lot of players in our industry, and we’d like to be the first one there for a long time, barring unforeseen events.”

Lukewarm freighter activity

The freighter industry had very little activity at the air show. The flag carrier of Algeria, Air Algerie, placed a firm order with Boeing for eight 737-9 MAX passenger jets and tentatively agreed to place two used 737-800 passenger jets in the freighter conversion program. The airline operates 55 passenger aircraft and this will be the first dedicated freighter aircraft.

Earlier, Air Tanzania had taken delivery of its first 767-300 production freighter, marking Boeing’s first sale of a new-build freighter to an African carrier, indicative of the emerging export-import market of perishable goods, pharmaceuticals and e-commerce products.

Embraer also signed a letter of agreement with Lanzhou Aviation Industry Development Group for 20 E190F and E195 E-Jets Passenger-to-Freight Conversions (P2F). Embraer and Lanzhou intend to cooperate on establishing of E190F and E195F conversion capability in Lanzhou, China, which will support and accelerate the introduction of E-Jet first generation freighters to Chinese market.

The cooperation will serve as an initial starting point for both companies to leverage their strengths, jointly promote the development of Lanzhou’s air transportation industry, and boost the economy around the airport.

Airbus announced the winners of the A350 freighter livery design competition and the winners were two young brothers from Canada, Quinnten and Ellisten, and John Feehan, a graphic designer from Ireland.

The newest freighter to the large cargo market is the A350F, bringing latest-generation innovation from the A350 with reduced fuel burn and CO2 emissions. The A350F is tailored to handle all future requirements for the large freighter segment – which Airbus forecasts will induct around 540 new aircraft for growth and replacement by 2040 to serve the general freight, express and e-commerce markets.

For example, the A350F’s flexibility includes compatibility with the standard AMJ-type container in a side-by-side layout, which the express cargo companies use today. While for the general freight operators the aircraft also offers the right pallet cargo density of 9.5 pounds per cubic feet.

There certainly was a dearth of orders for the freighter segment, reflecting that the downturn in air cargo demand is forcing cargo airlines and leasing companies to go slow on acquisition of new freighters, unlike the upward trend the segment saw during the height of pandemic with pronounced movement of medical and other essentials unlike passenger travel which was curtailed.