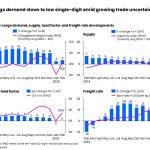

Airfreight rates still above pre-Covid levels

Airfreight rates continued their downward spiral in January but are still above pre-Covid levels.

The latest statistics from the Baltic Exchange Airfreight Index (BAI) show that average rates – both contract and spot – paid by forwarders on services from Hong Kong to North America in January declined to $6.14 per kg compared with $6.50 per kg in December and $10.90 per kg a year ago.

However, rates on the trade are still 67.8% above the $3.66 per kg registered in January 2019 (pre-Covid).

It was a similar story on services from Hong Kong to Europe where prices fell to $4.96 per kg from $5.52 per kg in December and $6.61 per kg a year ago.

On this trade, rates stood at $2.83 per kg in January 2019.

Rates are supported by higher fuel prices, the lack of bellyhold capacity on certain trades and ongoing expensive charter/BSA operations signed at the height of the pandemic.

On capacity, figures from Boeing presented at the recent World Cargo Summit show that overall capacity in November was only around 3% behind 2019 levels, but belly capacity was 23% down, with the difference made up by a 16% increase in dedicated freighters.

“One thing to note is that although index levels for the biggest outbound destinations such as Hong Kong and Shanghai are still well above pre-Covid levels, it is not the case for some smaller but also significant markets – such as Vietnam and India,” said Neil Wilson of data provider TAC Index in the latest Baltic Exchange market update.

“For the bigger BAI indices, such as Hong Kong and Shanghai, in what was only recently such a hot market many shippers were so anxious to secure capacity they were taking as much cargo space as they could on contract.

“This might mean that some are still paying prices even now well above spot levels.

“For other markets, like India and Vietnam, a much higher proportion has always been ad hoc business conducted at spot rates – with prices often much more volatile.

“That said, contracts recently being renegotiated for 2023 have generally been getting done at lower levels too – even with rising levels of business in China, which is finally starting to reopen post-Covid, as that has also had the effect of boosting capacity into a weak market.

“Initial research also suggests that falling demand from consumers is also visible in the data. Prices generally falling fastest from locations which have the highest proportions of consumer goods in their exports.”