DUBAI: A new technology based on artificial intelligence designed to detect counterfeit products has been introduced in Dubai.

The department of Commercial Compliance and Consumer Protection (CCCP) at Dubai Economy said the use of “Entrupy” patented by a US company was adopted in line with the directives of His Highness Sheikh Mohammed bin Rashid Al Maktoum, Vice President, Prime Minister and Ruler of Dubai, to integrate artificial intelligence to protect consumers and trademark owners’ rights.

The AI-based device is linked to a vast database comprising thousands of microscopic images of branded goods, particularly leather products, watches and accessories as well as clothing. More branded products will be added to it during the last quarter of 2019.

“The new technology will make brand owners more confident of their rights being protected in Dubai and provide them with a fast and simple alternative in case they had registered their products here by conventional means. They can now use the tech solution to feed data and images relating to their product electronically,” said Mohammed Ali

Rashid Lootah, CEO of CCCP.

With the new device, the inspector can detect counterfeit goods with high speed and accuracy, there by, eliminating time-consuming communication and verification with trademark representatives.

LOS ANGELES: Virgin Hyperloop One is building the world’s first long-range test track for hyperloop track, a research and development center and a hyperloop manufacturing facility north of Jeddah as part of its partnership agreement with Saudi Arabia’s Economic City Authority (ECA), the companies announced.

The project, which involves building a 35-km hyperloop track, could cut travel time between Jeddah and Riyadh to just 76 minutes from the current over 10 hours and just 48 minutes to the nearby Abu Dhabi in the United Arab Emirates (currently 8.5 hours), is an impetus to the Kingdom’s goal of developing Saudi as the Silicon Valley of the Desert under Crown Prince Mohammad bin Salman’s Vision 2030.

Virgin Hyperloop One’s technology features depressurized tubes that carry on-demand passenger or cargo “pods” at speeds up to 1080 kilometers per hour. It’s success in Saudi positions the country as the gateway to the Middle East, Europe and Asia for both freight and passenger movement.

The study will focus on King Abdullah Economic City (KAEC), located 100 kilometers north of the Red Sea port of Jeddah. “Our partnership with Virgin Hyperloop One is a matter of pride for us and all of Saudi Arabia,” said Saudi ECA Secretary General Mohanud A. Helal who went to Los Angeles to seal the

deal.

“As we continue to help deliver the strategic pillars of Vision 2030, technology transfer and high-tech job creation opportunities that this relationship will bring are fundamental to our progress as a nation and our efforts to create opportunities for our bright young people.

Having hyperloop at King Abdullah Economic City is going to act as a catalyst for a Saudi Silicon Valley effect and galvanize our software development, high technology research, and manufacturing industries,” he added.

In parallel to the implementation of the Study, Prince Mohammad bin Salman College of Business and Entrepreneurship will collaborate on the creation and publication of an academic paper outlining the economic impact of a Hyperloop Center of Excellence in KAEC.

Additionally, experts from the King Abdullah University of Science and Technology (KAUST) will visit the Virgin Hyperloop One testing facility in Nevada to conduct a technical review, followed by the publication of an academic paper.

“I look forward to this collaboration with our visionary partners in the Kingdom of Saudi Arabia to turn this technology into a mass transportation solution,” said Jay Walder, CEO, Virgin Hyperloop One.

“In order to transform the industry, it needs to address key challenges and converge, bringing the distribution and transportation process together. The entire cargo industry should adopt centralized datasets, that are updated in real-time using Internet of Things (IoT), hastening processes and allowing buyers and sellers to access up to date and accurate information.”

The Internet of Things (IoT) is the latest buzzword in the air cargo industry often heard from cargo experts when they talk about digital innovations. IoT has the potential to revolutionize the connectivity of the supply chain by tightening efficiency in operations and in ways that were never possible before.

According to studies, the global Internet of Things (IoT) market size was valued at $212.1 billion and is expected to witness a growth of 25.68% from 2019 – 2026, reaching $1319.08 billion by 2026.

Approximately 87% of supply chain executives say they plan to increase their use of IoT over the coming months/years where around $6.8 trillion worth of goods are shipped annually. There is too much at stake not to adopt the latest technology- even if the expense seems high. An inability or unwillingness to embrace digital innovations end up costing more in the long run.

In an email interview with Air Cargo Update, Niranjan Navaratnarajah, cargo industry director, Unisys Asia Pacific explains why IoT is a necessary adoption in the air cargo industry for modernizing fast shipment processes.

Distribution process

The air cargo business is a very important business for the global air transport market and one of the main barriers to its modernization has been the over reliance on paper, stakeholders processing data from data islands which may well already be out of date, and duplication of data entry creating more opportunities for errors.

Navaratnarajah says, “In order to transform the industry, it needs to address key challenges and converge and bring the distribution and transportation process together. The entire cargo industry should adopt centralized datasets, that are updated in real-time using mobile devices, automation and Internet of Things ( Io T) hastening processes and allowing buyers and sellers to access up to date and accurate information.

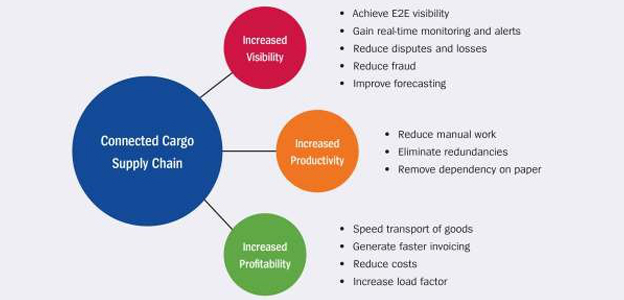

“Devices need to communicate directly with systems to improve accuracy and make real time data available to operators for swifter action on shipments. Devices need to monitor special and valuable cargo and alert operators if corrective action is required. This must be done while also protecting and securing data ie ensuring the right data is available to the r ight operators only. This ‘connected cargo supply chain’ offers customers greater visibility, certainty and satisfaction with faster delivery to customers’ door”.

Millions of cargo shipments move around the world every single day. Some are shipping internationally and some domestically. These shipments have one thing in common: delivery without delay.

And when it is not delivered as planned, it can create problems both for the shipper and the consignee. It is the objective of the freight forwarder to work with you to make the shipment as efficient as possible.

“The biggest problem is shipment ‘idle’ time – when it is sitting on the ground, not moving to its destination. This is primarily due to over reliance on paper; lack of up- to- date information to process shipments, data islands and stakeholders recreating the same data multiple times resulting in errors. Warehouses should not be storage locations – they should be highly efficient smart ware houses with very high throughput.

“A large proportion of delays is attributed to ground based processing of cargo so that’s where the collaboration, connectivity and optimization should be implemented to have the greatest impact on shortening processing times. Reducing this will improve the customer experience, optimize asset utilization, improve security and reduce unnecessary storage costs,” Navaratnarajah explained.

Order fulfillment and quick delivery is critical to customer experience. If customers are satisfied and delighted, they will order more frequently, thus, driving faster order cycle times.

Conversely, some organizations believe shorter order cycle times can trigger faster order fulfillment as the customer will order more often if their fulfillment time is shorter.

“At Unisys, we believe order fulfillment time needs to continuously improve in line with increasing customer expectations as the new age customer wants their goods to be delivered ever faster. To achieve this the industry must continuously improve processing times and collaborate across the transportation industry to integrate and process higher volumes faster to shorten the overall transport and fulfillment times,” said Navaratnarajah.

Reduction in time cycle

In a secure connected cargo supply chain, information flows automatically and mobile devices, wearables, sensors and drones enable staff to process shipments on the spot updating data in real- time; weigh bridges automatically exchange data with systems preventing data errors and fraud; and IoT enabled sensors on shipments proactively alert cargo systems and staff if a shipment has been left behind, in the wrong location, or is distressed.

Centralized data and reuse of most common data is pivotal for shorter cycle times. Ultimately using these means to process shipment quicker will improve the customer experience. Some players are already doing this, but an industry-wide approach is needed to transform the whole supply chain to shorten the order fulfillment times.

“Buyers and sellers must move their business to online ecommerce platforms – which can be their own in-house platform or one that spans a community of forwarders, airlines, general sales agents and handlers, such as Unisys Digi-Portal. Such real- time platforms enable buyers to interact with automated real-time inventory and not rely on stored data,” Navaratnarajah explained.

“Buyers and sellers must move their business to online ecommerce platforms – which can be their own in-house platform or one that spans a community of forwarders, airlines, general sales agents and handlers, such as Unisys Digi-Portal. Such real- time platforms enable buyers to interact with automated real-time inventory and not rely on stored data,” Navaratnarajah explained.

“In addition, growth in consumer online purchases has not only increased small parcel deliveries, it has created an expectation that customers can easily track their deliveries. Real-time data, used across the supply chain, enables greater visibility and trace ability of shipments. With 60 . 8 percent penetration of e-AWB in the cargo globally, the industry is well poised to move to centralized e-AWB based centralized datasets in the next 12-18 months. And as 8 of the top 10 countries of origin for e-AWBs are in Asia, and five of the six top airports of origin are Asian, we can expect this region, the ‘world’s manufacturing bowl’, will lead the way,” he added.

Moreover, artificial intelligence (AI), IoT and predictive analytics can improve visibility, efficiency and security. As cargo records are more accessible and accurate their information can be used to better manage, process and track cargo, particularly sensitive items like medicine or food, which must be stored at certain temperatures.

Moreover, artificial intelligence (AI), IoT and predictive analytics can improve visibility, efficiency and security. As cargo records are more accessible and accurate their information can be used to better manage, process and track cargo, particularly sensitive items like medicine or food, which must be stored at certain temperatures.

Sensors can record shipment characteristics and alert operators when shipments approach distress levels so that they can take action to prevent mishap and the resulting claims.

“AI powered by predictive analytics can help freight forwarders to ingest and analyze data in real-time, helping to determine if sensitive shipments require specific attention or if the shipping conditions need to be modified.

Predictive analytics can also generate data to enable airlines to better plan their routes, avoid inclement weather and validate the security of shipments. Mobile devices and smart phones will provide real- time visibility into shipments to assist to process goods faster, locate misplaced items, which can greatly impact the customer experience.

Connected devices will share data across and avoid the need to use paper and help process goods faster. Integrated with such targeting tools, the connected cargo approach would improve the clearance and tracking of shipments from loading to arrival.

“Also, moving to a digital data- based cargo supply chain enables the integration of advanced security information and event management (SIEM) tools, such as the Unisys Stealth® platform with automated Dynamic Isolation, to protect customer information and shipment data from being accessed or modified by unauthorized parties, preventing data theft and cargo fraud”.

Is air freight a challenging market?

Adaptation of technology is disparate across the stakeholders that results in multiple data creation and data islands. Supply chains are often broken due to the limitations of the lowest common denominators.

Regulators demand more real time knowledge of the goods that are being imported and expect airlines to report accurately using data from source.

Regulators are holding airlines responsible to the data that are being filed. They are also demanding that airlines use common data sets such as harmonized codes to report goods for approval.

Acceptance and delivery of goods at customers’ door are done through multiple means and without digital signatures and not knowing the condition of goods. Claims are raised and settled with no evidence of the condition of goods at handover.

Airlines often face bad debts and write offs due to insufficient credit control. At the end of the spectrum operators aren’t privy to detailed analytics and visualizations.

“Being able to capture real-time data by securely integrating mobility, IoT and data automation to make updates on the spot and exchange information faster will reduce the time that cargo is left on the ground. The Cargo and logistics industry is laden with manual activity and is paper driven, information sharing is limited and stakeholders have to create and process their own data multiple times often delaying access to information to process goods faster. I o T with devices and connectivity will significantly change the way data and access to real time data is used to process cargo shipments. Operators will be using real time data and customers will have access to up-to-date knowledge of their shipment movement. This will significantly alter the transportation landscape to process goods faster to shorten the order fulfillment cycle.”

Unisys has more than 55 years of experience providing innovative IT solutions to the travel and transportation industry. Digistics is a holistic and integrated modular air cargo software logistics solution that allows carriers to streamline freight management and improve their operational efficiencies.

“ We provide independent customer buying and selling portals, app-based mobility solutions for the warehouse and door delivery services, device integration and data sharing, sensors that record shipment behavior through the journey including alerting during distress, piece level tracking including pharmaceutical t racking, safe transport of pets are some of the solutions Unisys provides to the industry.

“The Digi-Connect module uses a common platform to collaborate with stake holders for information exchange through open APIs. Underpinning all of these is an advance analytics and visualization layers that provides advance views of the trends, behaviors and predictions.”

Are smart warehouses a reality?

According to Navaratnarajah, smart warehouses indeed are a reality, “In 2017 we predicted that to meet the growing demand for small parcel deliveries and e-Commerce boom, warehouses will transform from a storage location, to a dynamic facility using Io T and voice artificial Intelligence (voice AI) enabling faster processing of more shipments to generate a higher return on the real- estate investment.”

Just as connected wearable devices such as smart watches are becoming mainstream in the consumer world, IoT-based technology will create the ‘smart warehouse’ of the future.

Drones and robots will augment human activity and perform high volume tasks that were not done in the past. Device communication is central to data sharing and speeding processing in the warehouse. Warehouses will no longer be storage locations but processing centers that will have high throughput.

“Such efficiency will attract more cargo from less efficient locations and develop transshipment hubs. Recent innovations such as smart glasses used to display information triggered by a barcode or QR code on a container will be taken to a new level by incorporating scanners to automatically capture and input information into the warehouse system, and integrating voice AI to initiate actions,” he concludes.

Similar technology is already used in digital assistants such as Siri, Cortana or Amazon Echo. Unisys expects cargo operators to invest in converting machine commands to voice within the next three years.

Future global t rade will be significantly powered by online e- Commerce boom that will demand more transport by air, warehouses will be at the epic center of enabling this. Warehouses will have to deliver the highest efficiency if this is to be sustained. Highly automated and connected smart warehouses will, thus, be essential to augment this and help the cargo industry grow.

Boeing, Brexit and sluggish business dominate Paris Air Show

Boeing, Brexit and sluggish business dominate Paris Air Show

Business was obviously a bit sluggish at the airshow. In 2017, the show had stronger than expected orders, underlining the robust health of the airline industry. It did business worth over USD150 billion in 2017 and this edition it was down to USD140 billion. Some attribute it to the general state of world economies and some point to the fact that Boeing Commercial is yet to recover from its debacle.

The world’s numero uno airshow, Paris International Airshow at Le Bourget, has its ups and downs and this edition, 53rd, was marred by reduced business— nearly US$10 billion less than the previous event.

Mainly because one of the key players in commercial aircraft business – Boeing – going through a rough patch following the back-to- back accidents involving the Boeing 737 MAX where some 346 people were killed in Indonesia and Ethiopia.

The accidents prompted airlines across the globe to ground their B- 737 MAX planes indefinitely and Boeing to re-examine extensively the model and rectify the problems on its software program. The incidents also forced the aviation sector to put more emphasis on safely policies.

Besides the Boeing-factor, Brexit has also been looming large on the aerospace and defence sector in Europe. It remains to be seen how the European Union and the United Kingdom will wade through the rough currents.

Airbus dominates

Back to commercial airlines, Airbus ruled the roost, having easily edged out its archrival Boeing. The US aerospace giant opened its account with freighter bookings.

GE Capital Aviation Services (GECAS) entered into an agreement with Boeing for purchase rights of 10 737-800 Boeing Converted Freighters (BCF). GECAS also signed for 15 extra purchase rights for the same aircraft. The Senior Vice President of GECAS Cargo, Richard Greener said “Our leasing customers are very pleased with the versatility and reliability of these freighters.”

ASL and China Airlines also endorse BCF

Besides huge orders from Qatar Airways, Boeing had freighter wins from ASL Aviation Holdings DAC which signed for 20 737-800 BCF (with 10 firm orders and 10 purchase rights).

Since its launch, the 737-800 BCF has bagged 120 orders and commitments from eight customers worldwide.

China Airlines also placed orders for six 777 freighters in their bid to expand the freighter business and also modernize their fleet.

Business was obviously a bit sluggish at the airshow. In 2017, the show had stronger than expected orders, underlining the robust health of the airline industry.

It did business worth over USD150 billion in 2017 and this edition it was down to USD140 billion. Some attribute it to the general state of world economies and some point to the fact that Boeing Commercial is yet to recover from its debacle.

What really propped Boeing was the huge order of the International Aviation Group for 200 airplanes (mix of 737 Max 8 and Max 10) and it is said that IAG had a ‘sweet deal’, valued at over USD24 billion.

Boeing Commercial Airplanes CEO Kevin McAllister said, “We are truly honored and humbled by the leadership at International Airlines Group for placing their trust and confidence in the 737 Max and ultimately, in the people of Boeing and our deep commitment to quality and safety above all else.”

Regional aircraft players pitch in

The regional aircraft segment also did fairly good business with both ATR and Embraer having quite a few signing moments. At Paris, ATR, partially owned by Airbus, announced the launch of ATR 42-600S which has feature of shorter take-off and landing, using 800 meter runways.

ATR had 145 new orders at the show, being the third largest seller by units. Embraer which is celebrating its 50th anniversary also had a good outing. Embraer picked in all 78 new orders with United Airlines ordering 39 E175s (including 19 options); KLM Cityhopper 35 E-195 E2 (including 15 firm); 2 each from Japan’s Fuji Dream and Spain’s Binter.

CFM gets record-breaking orders

On engine sales, CFM, a joint venture between GE and Safran, notched up a huge order from India’s low cost airline IndiGo. CFM engines will power 280 Airbus A320neo and A321 neo aircraft.

“IndiGo has been a CFM customer since 2016 and currently operates a fleet of 17 A320ceo aircraft powered by CFM56-5B engines as part of a total fleet of 215 A320/A321 family aircraft. Delivery of the first LEAP-1A- powered A320neo is scheduled in 2020,” IndiGo said.

AirAsia also decided to purchase of 200 Leap-1A engines to power the airline’s 100 A321neos.

Pratt & Whitney signs up with JetSmart

Pratt & Whitney, a division of United Technologies Corp announced that JetSmart had selected the Pratt & Whitney GTF engine to power 85 firm order Airbus A320neo family aircraft.

Pratt & Whitney will also provide JetSmart with engine maintenance through a 12-year comprehensive service agreement. The first aircraft is expected to be delivered in the third quarter of 2019.

Safran Helicopter Engines receives EASA certification

Safran Helicopter Engines has received EASA (European Aviation Safety Agency) Type Certification for its Arrano 1A engine, installed in the Airbus Helicopters H160.

Arrano is a new generation engine

in the 1,100 to 1,300 shp power range, perfectly suited for new four-to-six ton helicopters. The H160 made its first flight with the Arrano in January 2016.

7 top aerospace companies join hands on aviation sustainability

While the aircraft and engine manufacturers competed aggressively for a bite of the aviation pie, seven of the top aerospace players – Airbus, Boeing, Dassault, GE, Rolls Royce, Safran and UTC have joined hands for aviation sustainability. The seven big players were represented by their technology heads and they are – Grazia Vittadini, Chief Technology Officer (CTO) of Airbus; Dr. Greg Hyslop, CTO of The Boeing Company and senior Vice President of Boeing Engineering, Test & Technology; Dr. Bruno Stoufflet, CTO of Dassault Aviation; Dr. Eric Ducharme, Chief Engineer, GE Aviation; Paul Stein, Executive Leadership Team, Rolls Royce; Stephane Cueille, CTO of Safran; and Paul Eremenko, Engineering and R&D head, United Technologies Corporation.

Joint statement

In a joint statement issued by the seven companies, they outlined three major technological elements to sustainable aviation:

“We are excited by this third generation of aviation and, even though all of the represented companies have different approaches, we are all driven by the certainty of its contribution to the role of aviation in a sustainable future. We believe aviation is entering its most exciting era since the dawn of the Jet Age. This third era promises a transformative positive impact on lives around the globe – and we stand ready to make it a reality,” the joint statement reads.

Commercial, business and military aircraft and systems got a lot of visibility at Le Bourget, the venue of the Paris Airshow which attracted 2, 453 exhibitors ( 1, 185 French exhibitors) from 48 countries.

The top five exhibiting countries were USA, Germany, Italy, United Kingdom and Belgium. There were 150 start-ups from 21 countries.

About 140 aircraft were on display (both static and aerial). In all, the airshow had footfalls of 3,16,470. While these numbers are good, the orders are not commensurate as the shadow of Brexit still looms large and the general aviation economic downturn.

Hungary’s capital, Budapest, is getting busier with more Foreign Direct Investment (FDI) coming, creating business activities and tens of thousands of jobs despite mixed opinions about the country’s political course.

Described as the fastest developing urban economy in Europe, Hungary is attracting more FDI mainly from Western Europe because of its corporate tax policy fixed at 9%, positive business environment and an educated and competitive workforce.

Air cargo and its supply chain in Hungary directly benefit from this positive development, keeping the industry busy and feeding its economy for more growth.

René Droese, Director Business Unit Property and Cargo, Budapest International Airport, knows this first hand. He’s responsible for leasing properties at the airport and the cargo operations.

It’s a big responsibility that Droese takes to the heart, constantly traveling to different cities, promoting their products and services. The result: nearly 60 percent growth in cargo volumes over the past three years while keeping a double-digit increase year-on-year.

Hungary’s automotive industry delivers about 800,000 cars annually, mostly German-brands for export overseas. That as well as the country’s growing pharmaceutical and tech industries keep BUD Airport Cargo busy all-year-round.

“We’re quite very happy with our growth,” shared Droese to Air Cargo Update in an interview in Munich on the sidelines of Air Cargo Europe 2019. BUD Airport is scheduled to open this year “Cargo City”—a sprawling expansion to its existing facilities as demand for more storage space and freight movement in Budapest increases fueled by its vibrant export-import economy.

“Once it is built, additional cargo will come. The air cargo relevant industrial output is booming in our region, including export and import cargo for the automotive, electronics, pharmaceutical industries and the very important e-commerce market. Our plan is to attract more freighter and belly cargo routes to our airport,” said Droese who is extremely excited about their project.

Droese began his career as a leasing agent more than 22 years ago, eventually moving on to airport acquisitions, before taking on his role at BUD Airport in 2007 upon the request of its new owners—the Canadian State 55.438 % (AviAllinance GmbH owned by PSP Investments), Government of Singapore 23.334 % and the Province of Québec (pension funds) 21.228 %.

Droese described the air cargo industry as somewhat of a puzzle where each piece in the supply chain must be included to make it whole.

“Air cargo is like a puzzle. It’s a community of people— airlines, forwarders, shippers, among others—you have to bring them all together. This is an exciting industry. I am enjoying it every day,” he said.

In his free time, Droese, a father of two boys, says he loves spending it with his family.

He also regularly runs, even joining marathons, when his schedule permits. “I love running. I run for as long as I can possibly reach. I also join marathons.”

And he also enjoys traveling. He’s been to so many countries and cities all across the world but admits, “I’ve never counted them.” South America and South Africa though remain on his bucket list.

“I enjoy traveling. It exposes me to different cultures and nationalities. It’s fascinating to see and learn how people think and behave differently,” said Droese.

The Dutch government is working on a new framework for airfreight, and the sector needs to make its opinions known, according to Maarten van As.

The managing director of Air Cargo Netherlands says that to ensure air cargo can continue to grow, the association and the cargo sector as a whole must be concrete in its inputs. Van As stresses that capacity figures should not be stared at blindly, but how they are used needs to be studied.

He says, “Look carefully what this means for the Dutch economy, for employment opportunities, for the business climate for companies and, also for the quality of the Schiphol network. Dare to be selective and, on the basis of clear consideration, reserve slots for full freighters.”

The allocation of slots at Schiphol has been an issue for the last two years. Air traffic movement capacity at Schiphol is limited to 500,000 until 2020 to balance aviation growth, noise reduction and environmental quality. There is just a slight issue, this limit was reached in 2017.

The impact of the slot shortage was felt by the freighter sector, which has seen a significant fall in movements. A local rule was created to give freighters more space, and it was formalized in May this year.

Van As says: “This local rule is not to be THE solution though, but it is a positive signal. At this moment the sector and the Dutch government are together looking for solutions and the government has recognized the importance of the airfreight market for the Dutch economy.”

The cabinet has allowed for a moderate growth of slots at Schiphol, something van As describes as a “positive and very important step”.

The limited availability of slots is not the only reason for full freighter traffic to fall at double-digit rates; the whole air cargo sector has been struggling and the global economy is falling due to worldwide issues.

Tougher times are sometimes a good thing, van As comments: “This flattening of the market is all the more reason for the cargo community at Schiphol to put more energy intro preparing for the future.”

He says the drive to optimize air cargo processes at Schiphol is at the heart of the Smart Cargo Mainport Program, saying: “This program is an example of how cargo flows are advanced by cooperation with our cargo community.”

The air transport industry has to consider changing public opinion. Van As says: “Whereas air transport used to stand for progress and modern times, now the discussion covers environmental issues and inconvenience for surrounding areas. Politics must find a new balance and we are very happy to see that the Dutch cabinet takes this very seriously.”

Minister of infrastructure and water management, Cora van Nieuwenhuizen has been discussing the matter with relevant stakeholders, trying to find a way to allow growth.

Van As says: “From 2021 and forward, there will be a transition period in which the aviation sector can earn the right to grow to 540,000 slots by achieving demonstrable reductions.”

While this is going on, belly capacity is being utilized more efficiently. Schiphol Group has developed a tool combining cargo and passenger data to identify opportunities to update the aircraft operating routes.

Van As says freighters must remain important at Schiphol. He says: “The sector operates in an enormous competitive international playing field in which both belly cargo and full freighters must have independent, strong positions. Only in this way can Schiphol position itself as a powerful cargo hub.”

Filipino airline Cebu Pacific has taken delivery of its first ATR 72-500 Freighter, having converted the aircraft from passenger form.

The freighter is the first of its type in the Philippines, and will let Cebu Pacific carry cargo to destinations served by airports with short runways only suitable for turboprop aircraft.

The ATR is equipped with a Large Cargo Door allowing it to carry up to seven LD3 containers or five PBJ pallets, carrying up to eight tons of cargo.

The conversion was performed at the Sabena Technics facility in Dinard, France.

The ATR 72-500 is the first of two passenger aircraft to be converted for cargo use and operated by subsidiary Cebgo.

Two large consignments of airfreighted Norwegian salmon bound for Asia have been turned back on landing in Russia. More than 100 tons of fish on two different flights were ordered to return to Oslo’s Gardermoen Airport without explanation.

According to the managing director of one of the freight forwarders impacted by the Russians’ fishy decision, no reason has been given for the decision.

Bent Jaabaek, CEO and managing director of Air Cargo Logistics, says, “The incident is still a mystery and questions still remain unanswered. No official letter has been received either. That’s the current status.”

Coast Seafood CEO Sverre Søra is reported to have told a Norwegian fish farming website that the fish destined for South Korea has also been returned. The company is now reported to be seeking alternative routings for the fish.

Norwegian government officials in Oslo and Moscow have worked to discover why the loads were turned back. Norwegian salmon was embargoed by Russia in retaliation for western sanctions over its aggressive actions in Ukraine five years ago. In 2014, Russia imposed a ban on Norwegian foods. Fish farmers circumvented this by shipping to Belarus, which has a customs union with Russia.

time:matters, the expert for global Special Speed Logistics, has established a new hub in Brussels and extended its services to Africa. The highly efficient standardized network for global transports now includes 16 stations on the African continent, with time:matters serving 14 of these with standardized express transport solutions for the first time. With immediate effect, the company is offering its customers 81 weekly direct flights between Brussels and the 16 African destinations.

time:matters is using the existing Brussels Airlines (SN) network, and can therefore offer the fastest possible transport without stopover direct to the respective destination region. The expert in complex logistics solutions is using the new hub at Brussels Airport for this purpose. Customers will enjoy the same benefits there as at time:matters’ other European hubs in Frankfurt, Munich and Vienna: thanks to direct apron access, combined with physical monitoring of all shipments, time:matters guarantees not only speed and flexibility but also superb reliability and quality. Customers from the Benelux countries in particular will benefit immediately from rapid handling at the new hub from 120 minutes, while time:matters is offering transit times from 90 minutes for international shipments via Brussels.

The transport of time-critical shipments will now be available with the usual high level of reliability and precision for the destinations Abidjan (ABJ), Accra (ACC), Banjul (BJL), Bujumbura (BJM), Conakry (CKY), Cotonou (COO), Douala (DLA), Dakar (DSS), Entebbe (EBB), Freetown (FNA), Kigali (KGL), Luanda (LAD), Lomé (LFW), Yaoundé (NSI), Ouagadougou (OUA) and Monrovia (ROB), as well. The new stations in the 16 African countries offer import shipment handling times starting at 120 minutes. This means that time:matters can handle time-critical transports, such as spare and machine parts for the local oil, shipbuilding, mining and food industries, in a time- and cost-efficient manner. In addition to standardized transport, time:matters also offers tailor-made solutions for time-critical and sensitive shipments. The right transport solution can therefore be developed individually for each customer’s specific logistical challenge.

“We are considerably extending our standardized offering of Special Speed transport solutions in the African market by including 14 new stations,” explained Alexander Kohnen, CEO of time:matters GmbH. “Thanks to the new hub in Brussels, we are in a position to offer our customers access to our highly efficient network with the usual level of reliability and speed.”

In Brussels, time:matters customers enjoy services such as individual pick-up and delivery of shipments upon request, prioritized loading and the usual customer service support around the clock. Furthermore, there is no weight limit in respect of shipments ex Brussels – everything can be accommodated, from a few kilograms to several tons.

Softbox, a leading global innovator and provider of temperature control packaging and thermal covers for the life science and logistics industries, has announced the appointment of Kevin Valentine as new global CEO, effective 1 September 2019.

Consistent with the Softbox executive succession plan, Wayne Langlois, global president, Softbox, will return to his former position as a board member and will work in close collaboration with Valentine and his global leadership team.

Valentine has over 25 years of global executive leadership experience in the temperature control packaging and thermal covers solutions for the pharmaceutical industry. Valentine will ensure that the Softbox brand continues to expand its reputation for the highest quality product innovation and client service globally.

Langlois commented, “Kevin is a very experienced and well-respected industry leader and I’m delighted to appoint him as my successor in designing and executing our exciting growth plans.”

Commenting on his new role, Valentine added, “I’m excited to deliver on the opportunity to become Softbox’s global CEO. I look forward to working with our global team to lead the company to the next step of its strategic and financial success in the market.”